Manage Your Group's Funds With OurGroupOnline™

OurGroupOnline is a great way to manage your group's funds.

OurGroupOnline is a great way to manage your group's funds.

If you are your group's treasurer, please take the time to carefully read this chapter of the User Guide before you get started.

Your first steps will be to:

- Decide if you want to implement fund accounting and, if so, set up the funds, categories and transaction types as needed

- Create a Group Account for your group's checking account.

- Enter a starting balance for your group's checking account.

- Enter the starting balance for each member of your group, either by:

You should also decide if you want to accept credit and debit card payments using either PayPal™ or Square, and configure your system accordingly.

You will then be ready to settle into a routine for managing your group's funds.

This will involve these activities:

- Accept payments at meetings from members

- Record all other deposits

- Record expenses associated with group activities

- Charge the cost of group activities to those members who participated

- Reconcile your monthly bank statement

- Charge dues to active members

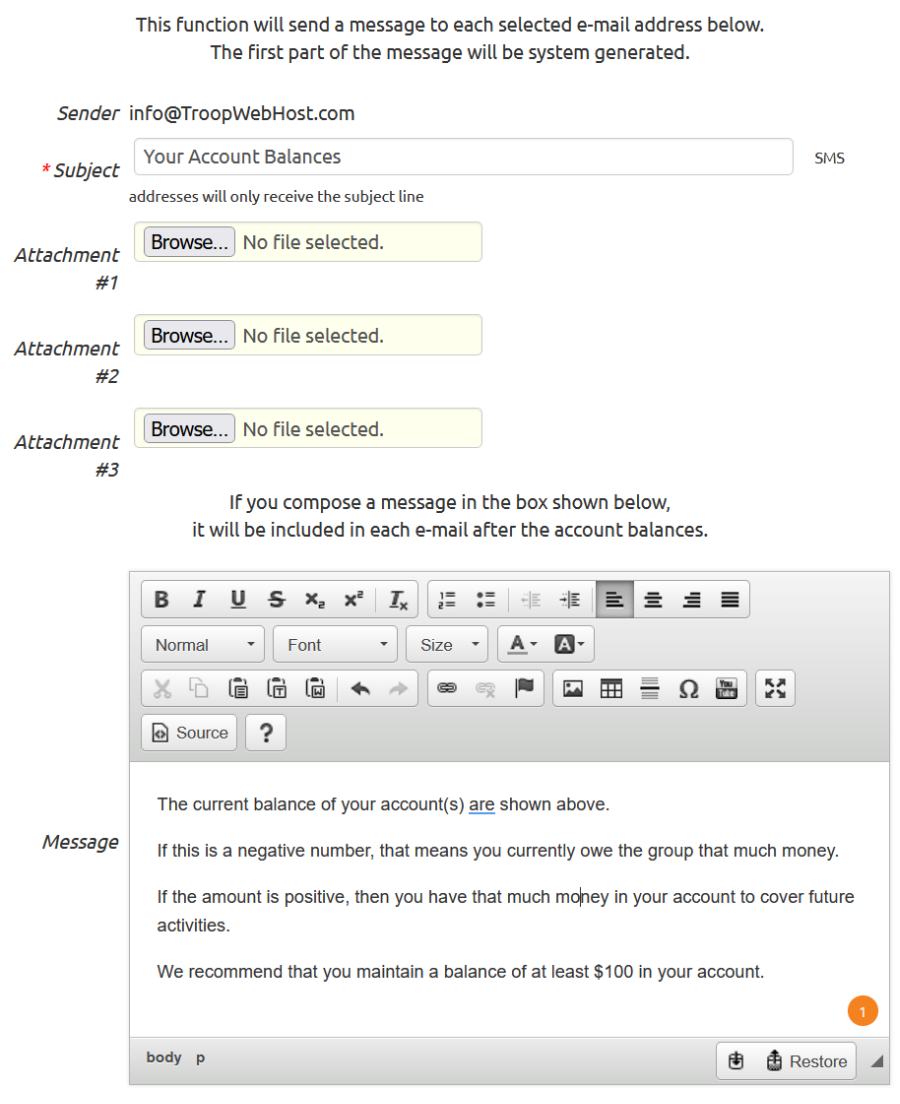

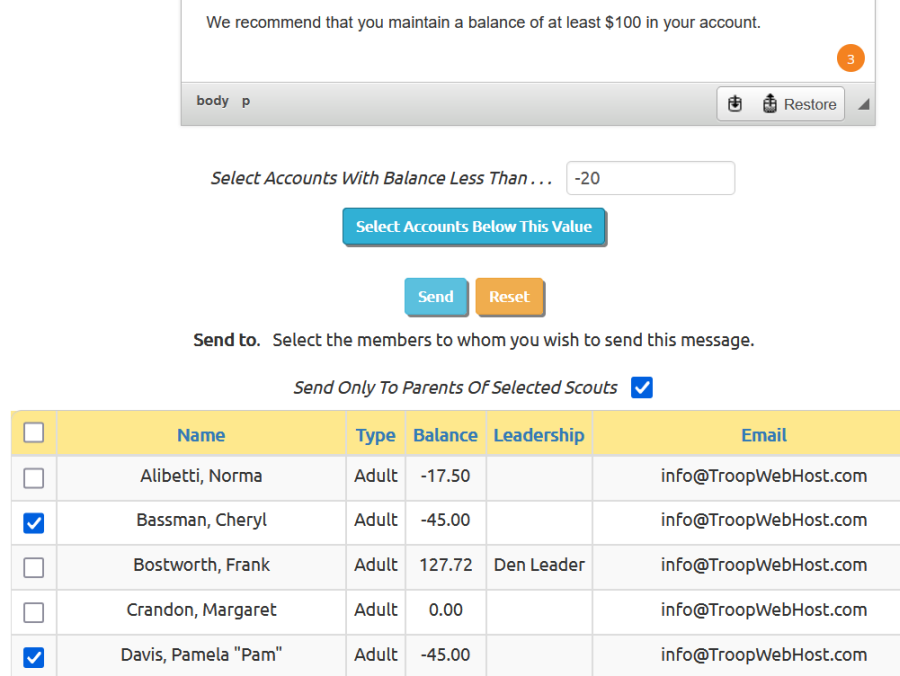

- Send current balances to all members

The rest of this chapter will explain these operations in detail.

Types Of Accounts

OurGroupOnline can track the balances in four types of accounts:

OurGroupOnline can track the balances in four types of accounts:

- Group Accounts

- Member Acounts

- Events

- Funds (optional)

Group Accounts keep track of the total funds on hand in various locations, such as your group checking account, petty cash drawer, or PayPal™ account.

Many groups only need one Group Account, which represents the group checking account. The balance in this account should always match the current balance in the checking account.

This balance may include funds that belong to those members who have positive balances in their accounts. The portion that does not belong to individual members belongs to the group.

Member Accounts track the current balance for each member of the group. The balance in a member account will reflect all of the payments received from that member, credits from fundraisers, and charges for participating in group activities. A member account is automatically created for each person when you enter them into your roster.

Think of a Member Account as being like a credit card account. You can charge the account for expenses like dues and camping trips. You will credit the account when you receive money from that member.

With this system, expenses and payments are completely independent. There is no explicit connection between the transaction that charges a member for an event and the payment they submit for that expense.

To return to the credit card analogy, when you pay your Visa bill you don't pay for a specific item on your bill; your payment is simply applied to your total balance. OurGroupOnline member accounts work the same way.

As an example, a member could deposit $1,000 to his account at the beginning of the year, and then let that balance be used for his expenses as the year goes by.

Another member might end up with a negative balance after attending several events, and then pay off that balance with one payment.

The system can also track income and expenses for each Event in your calendar, such as banquets and fundraisers. Events can be used as sub-accounts to track a subset of the group's funds.

Funds are an optional way to track additional financial information. Funds are not recommended for groups who simply wish to track their checking account and individual member account balances.

You can change the balance of one or more accounts by entering Transactions.

Each transaction has a Transaction Type which determines the types of accounts it affects. For example, a Deposit To Member Account transaction will add to both the group checking account and the member account.

You will select a transaction type when you enter a transaction type. You will then be prompted for the specific accounts to be affected by this transaction.

Financial Hub

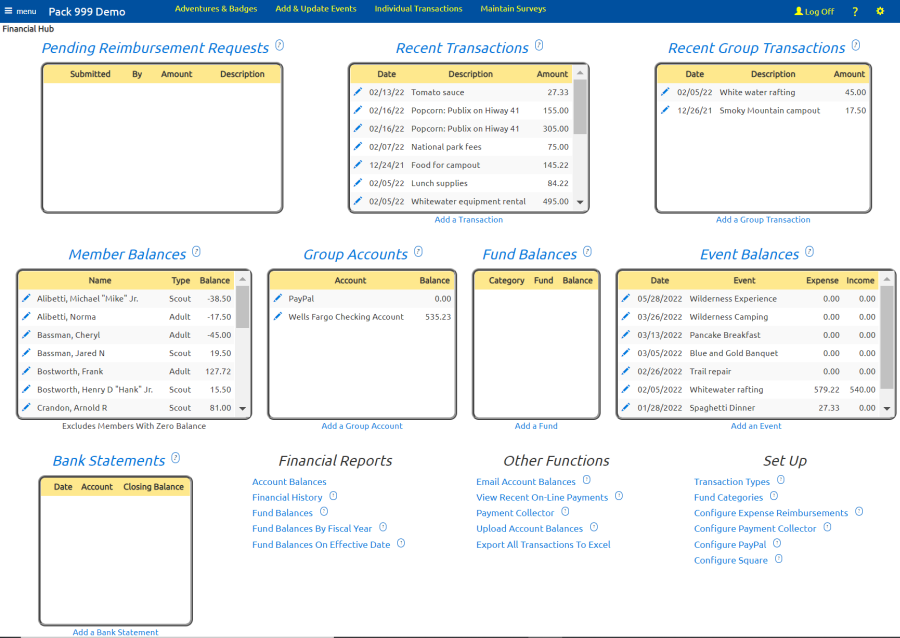

The Financial Hub is a great entry point for all of your accounting functions. It is available to any user who has a role that is authorized for the "Maintain Financial Information" or "Financial Hub" tasks. It is available at Money → Financial Hub.

Like all hubs, you can edit the Financial Hub to fit your group's requirements. This allows you to remove widgets you don't need - like the "Fund Balances" data window if you're not using funds. You may also add or replace widgets.

You can choose from the following Data Window widgets:

| Widget Name | Displays | Links To |

|---|---|---|

| Data Window - Money - Individual Transactions | The most recently entered transactions - not including those spawned by group transactions - in reverse order of when they were created. | The heading links to the Individual Transactions page. |

| Data Window - Money - Group Transactions | The most recently entered group transactions in reverse order of when they were created. | The heading links to the Group Transactions page. |

| Data Window - Money - Scout Balances | Every scout in your unit with their current balance. | The heading links to the Member Account Balances page. |

| Data Window - Money - Scout Balances With Reserve And Primary | Every scout in your unit with their primary, reserve, and overall balances. | The heading links to the Member Account Balances page. |

| Data Window - Money - All Adult Balances | Every adult in your unit with their overall account balance. | The heading links to the Member Account Balances page. |

| Data Window - Money - Active Adult Balances | Every adult in your unit with a non-zero balance. | The heading links to the Member Account Balances page. |

| Data Window - Money - Group Accounts | All group accounts | The heading links to the Group Account Balances page. |

| Data Window - Money - Fund Balances | All funds. | The heading links to the Funds page. |

| Data Window - Money - Event Balances | All events that are eligible for monetary transactions, based on their event type. | The heading links to the Event Balances page. |

| Data Window - Money - Pending Reimbursement Requests | All pending requests for expense reimbursement. | The heading links to the Expense Reimbursement Requests page. The update link takes you to a page where you can approve or reject that individual request. |

| Data Window - Money - Bank Statements | All bank statements that have been entered for reconciliation, with the most recent at the top. | The heading links to the Statement Reconciliation page. |

Unless otherwise specified above, the ![]() icon will allow you to update that row,

and the

icon will allow you to update that row,

and the ![]() icon

will allow you to send a message to that person or group.

icon

will allow you to send a message to that person or group.

The Financial Hub may also include these Menu widgets:

| Widget Name | Contains |

|---|---|

| Menu - Financial Functions | Other accounting functions that cannot be accessed from the Data Windows. |

| Menu - Financial Reports | All of the financial reports. |

| Menu - Financial Set-up | Supporting tables for the accounting subsystem. |

Budgets

Budgeting is an optional feature of OurGroupOnline which makes it easy for you to create an annual budget and track it against actual income and expenses.

This allows you to meet the first Journey To Excellence (JTE) requirement for planning and budget. It also helps you set your fundraising goals for the coming year.

Configuring your system to enable budgeting involves these steps:

- Review and extend the budget template, which is modeled on the BSA's recommended budget spreadsheet.

- Review event types to distinguish fundraisers from other activities.

- Update your transaction types to require budgets.

Add a fiscal year to begin creating a budget for that year. This defines the starting and ending dates for this fiscal year.

You can then enter the budget for this fiscal year:

- Enter your expense budget on the expense tab.

- Enter your budgets for the events scheduled for this fiscal year on the event budgets tab.

- Enter your income budget on the income tab.

- Enter your sales goals and expected income for each scheduled fundraiser in the fiscal year on the fundraiser budgets tab.

A major portion of the budgeting process is based on events. For each campout and other outings, you can create a budget which may anticipate charging back part or all of the expense to the participants. For fundraiser events, you can set the goal and the expected income for each fundraiser.

You can then track your actual income and expenses against each item on your budget.

All transactions that affect an event will be counted against the fiscal year in which the event is scheduled, regardless of the date of the transaction. So, for example, if FY25 runs from 1/1/2025 through 12/31/2025 and you have a campout scheduled for the first week of January, any purchases made in December of 2024 in preparation for that event will be counted against the FY18 budget.

All other transactions will be assigned to a fiscal year based on their transaction date.

If you have already entered transactions in the fiscal year for which you are creating a budget, you can assign those transactions to a budget item from the expense tab and the income tab.

When you enter new transactions which represent income or expense to the troop, you will be prompted for a budget item - unless that transaction relates to an event. Transactions that affect an event do not have to be assigned a budget item, since that is done at the event level.

The system can then provide reports to show the variance between actual and budgeted amounts for every budget item.

Budget Template

The budget template defines the line items for your budgets. These budget items are used for every fiscal year in which you create a budget.

Your system is pre-configured with a budget template based on Scouting America's Pack Operating Budget Worksheet. If this meets your group's needs, there is no need to change anything.

We do recommend that you review this template before you move on to the next step. To do this, please go to Site Configuration → Budget Template.

This page allows you to view the current budget template and make any changes needed before you begin creating your group's budget.

Click Add a New Item to add a new budget item, or use the Update buttons to change an existing item.

The Type determines the section of the budget in which this item will appear.

The Display Sequence determines the position of this item within the selected section.

The Item Name is the title for this budget item that will appear on all screens and reports.

Values Taken From Events should be checked for those budget items whose values will be derived from events. Line items for campouts and other outings should have this box checked. So should fundraisers.

For items not derived from an event, you can check Compute Budget Per Person (or other unit) if you wish to have the system prompt you for a per person budget amount and a count of how many to which it applies. The system will automatically compute the total for these items.

If you specify a default value, the system will fill in this value for this budget item for every fiscal year you create. If this is a "pers person" budget item, this value will be placed in the per person column; otherwise, it will be placed in the total field.

Use the Disabled checkbox to prevent this item from being added to any new budgets you create. This will not remove this item from any existing budgets.

Event Types

Event Types control many aspects of your events, including how they are categorized for budget purposes.

To review and update these settings, please go to Site Configuration → Event Types. Update an event type to see how it is categorized for the budget.

Scroll down to the "Financial" section, you see where you can designate the budget type.

This is really only relevant for events that allow monetary transactions.

The default value is "Activity", which is anything other than a fundraiser. This is the proper setting for campouts and other outings.

Select "Fundraiser" for any event type which is going to raise money for the group.

Transaction Types For Budgets

Transaction Types control the effect of each transaction that is entered into the system, including whether it affects performance against a budget item.

You can maintain your transaction types by going to Site Configuration → Transaction Types.

The default configuration of your site had budgeting disabled, so none of the transaction types affect a budget item.

You can easily implement budgeting in your transaction types by pressing the Enable Budget Using Recommended Settings button at the top of the page. This will invoke an algorithm that sets the expense or budget flag based on a pre-defined set of criteria.

If you have not altered the original transaction types or added new ones, this may be all you need to do.

But if you decide you wish to change these settings, please keep in mind these concepts:

Transaction types that affect events cannot be assigned to a budget. That is because these transactions will use the budget item assigned to the event. It therefore is unnecessary to specify a budget item for these transactions.

A transaction type cannot affect both budget expense and budget income. You must choose one or the other.

Transaction types should only be assigned to a budget category if they will affect the troop's income or expense.

To illustrate that last point, consider the setting for the "Deposit To Member Account" transaction type. You might think that this should be set to be an Income budget item, since it represents money flowing into the troop's coffers. However, this is not actually income to the troop at this point; it is simply money you are holding on behalf of this individual. It only becomes income to the troop when you charge that individual for something, which is why "Charge Member Account" does affect an income budget item, as shown below.

Similarly, the "Reimburse Member From Member Account" transaction type should not be assigned an Expense budget item, since it represents the disposition of money that doesn't belong to the troop.

If you have any questions or concerns about how the budget flags should be configured, please contact CustomerSupport@TroopWebHost.com.

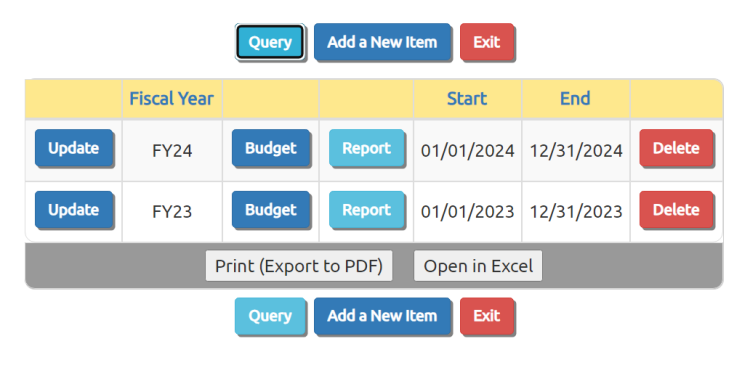

Fiscal Years

The Fiscal Year table lets you define your group's fiscal years. This is the first step in creating a budget.

To maintain your fiscal years, go to Money → Fiscal Years & Budgets.

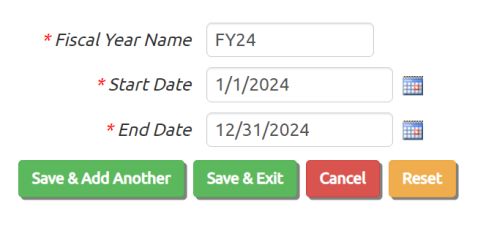

Click Add a New Item to create a new fiscal year.

Fiscal Year Name is the name that will appear whenever this fiscal year is referenced.

Start Date is the first day of this fiscal year.

End Date is the last day of this fiscal year.

For the budget "actual" totals, transactions that affect an event will be assigned to a fiscal year based on the starting date of the event.

All other transactions will be assigned to a fiscal year based on their transaction date.

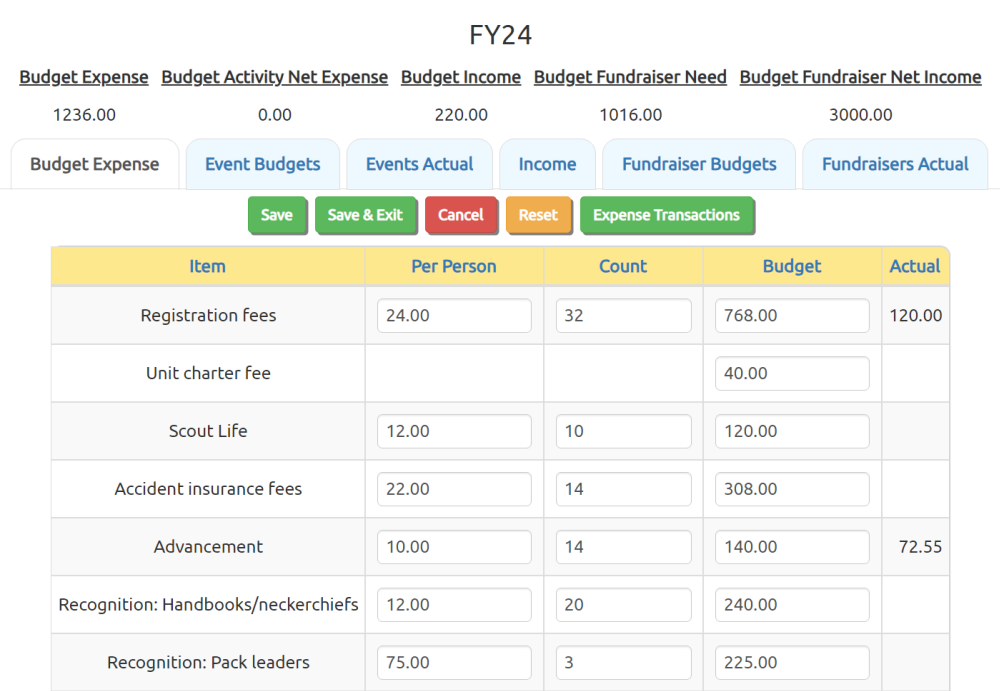

Expense

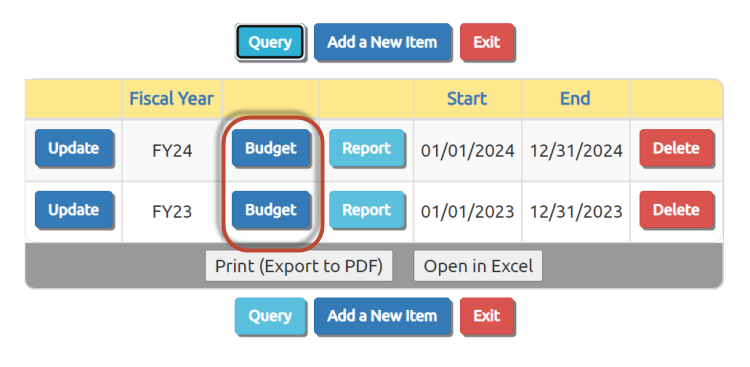

Once you've created a fiscal year, you can begin entering your budget for that year.

This is also done from Money → Fiscal Years & Budgets.

Click the Budget button to go to the Expense tab of the budget page.

This tab displays all of the expense budget items that are not linked to events, as determined by the settings in the budget template.

If the budget item is configured for "per person" computation, you will be able to enter a per person amount and count on that row, and the system will compute the total budget.

For other items you can just enter the total budget amount.

To save your changes on any of the tabs in this page, you can:

- Click Save

- Click Save & Exit

- Click on another tab

The Actual column displays the total of all transactions that are assigned to this budget item whose transaction dates fall within this fiscal year.

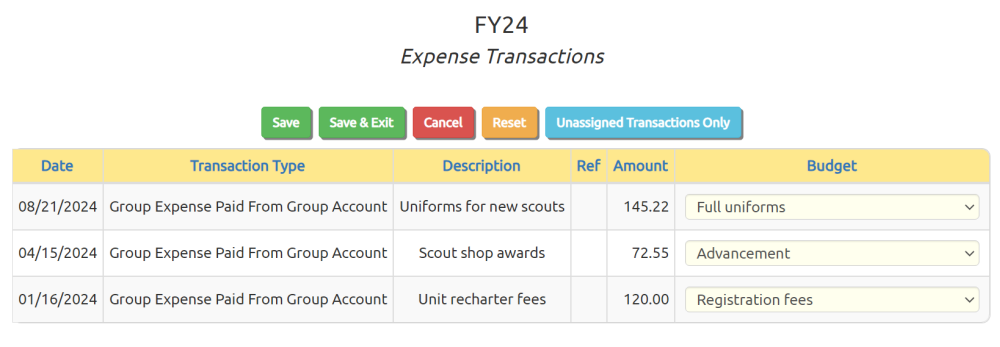

You can assign the budget item for transactions by pressing the Expense Transactions button.

This will display all of the expense transactions for this fiscal year that are not associated with events. Use the drop down list in the budget column to select the budget item for each transaction.

Click Unassigned Transactions Only for an easy way to set the budget items for old transactions which were entered without this information.

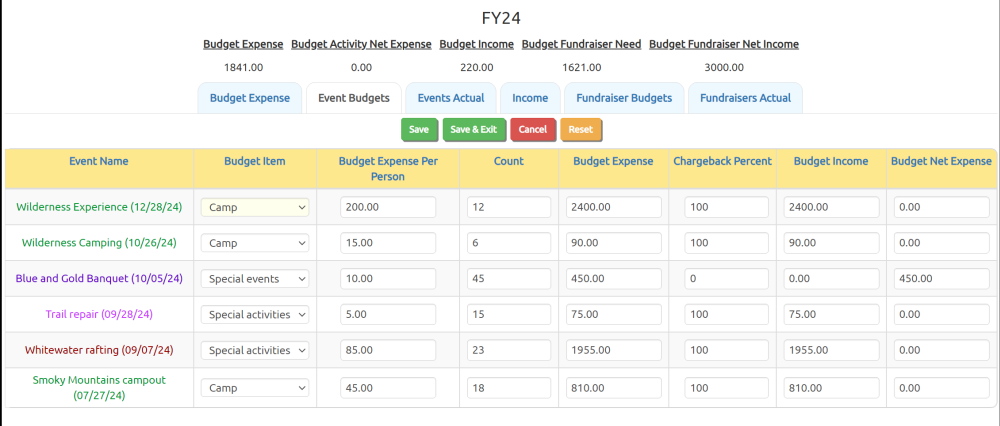

Event Budgets

The Event Budgets tab allows you to create a budget for each activity planned for this fiscal year.

This is the second tab on the Budget page reached from Money → Fiscal Years & Budgets.

For each event, you should first select the appropriate Budget Item from the drop down list. This is the budget item into which all of the expenses and income for this event will roll up.

Budget Expense Per Person is your anticipated cost of this event per participant.

Count is the expected number of participants for this event.

Budget Expense will be automatically computed based on the previous two columns. It represents the total expected cost of this event.

Chargeback. Most groups charge the cost of most of their outings to the members who attended. The Chargeback Percent column lets you enter a number between 0 and 100 indicating the portion of the expense you plan to charge to the participants. In most cases, this will be "100" if you plan to charge the entire cost of the event back to the participants.

The Budget Income column is the amount you expect to charge back to the participants. It will be automatically computed based on the previous two columns.

Budget Net Expense is the difference between the Budge Expense and Budget Income. This is the number that will be rolled up to the Budget Expense for this budget item.

As on the previous tab, to save your entries:

- Click Save, or

- Click Save & Exit, or

- Click on another tab

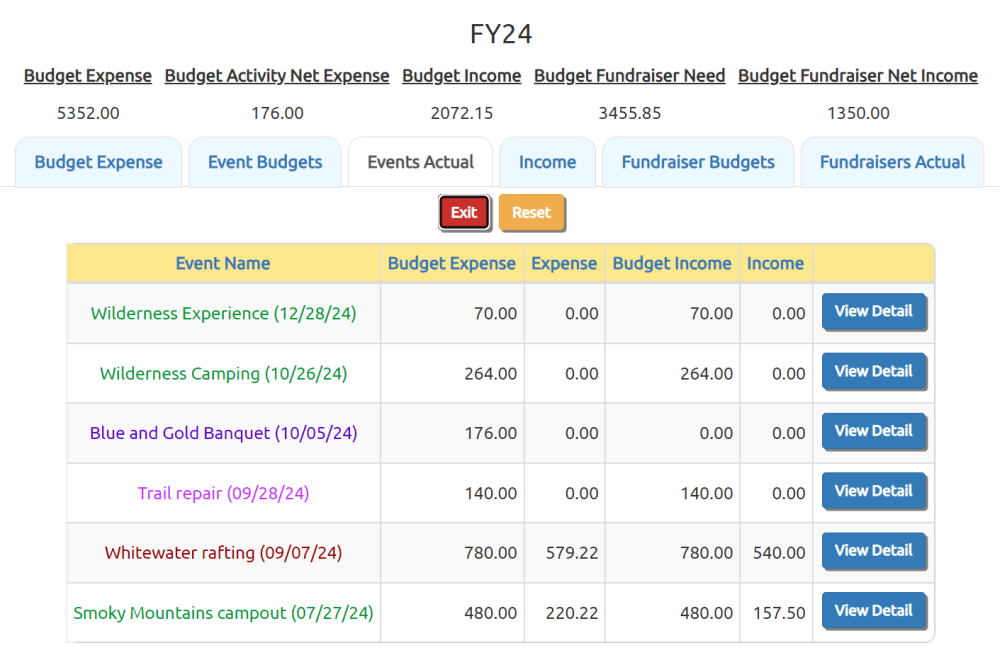

Events Actual

The Events Actual tab shows you the actual expense and income recorded for each of the events in this fiscal year.

This is the third tab on the Budget page reached from Money → Fiscal Years & Budgets.

For each event, it shows:

- Budget Expense, as set in the Event Budgets tab.

- Expense, from the debit transactions entered for this event.

- Budget Income, as set in the Event Budgets tab.

- Income, from the credit transactions entered for this event.

The View Detail button allows you to see the underlying transactions for this event. From there you can update individual transactions or add new transactions.

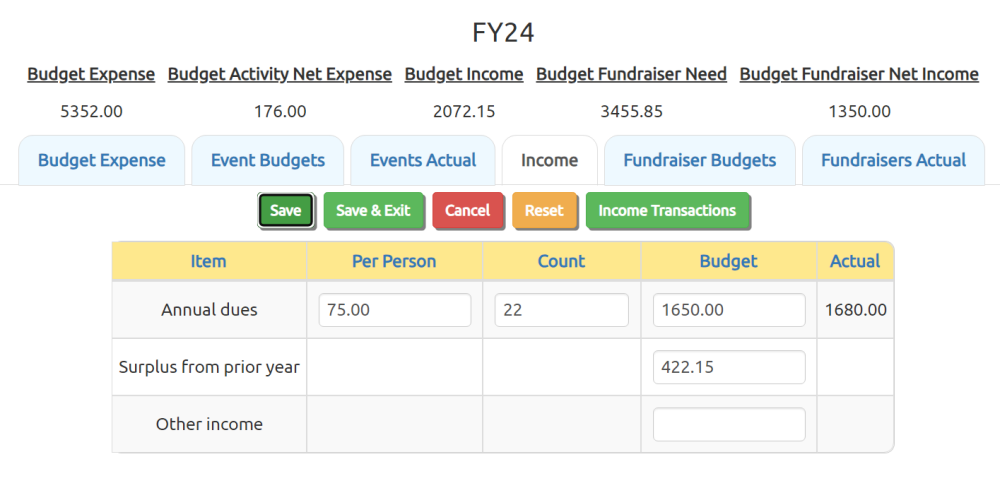

Income

The Income tab is where you plan your income for the fiscal year.

This is the fourth tab on the Budget page reached from Money → Fiscal Years & Budgets.

This tab displays all of the income budget items that are not linked to fundraising events, as determined by the settings in the budget template.

If the budget item is configured for "per person" computation, you will be able to enter a per person amount and count on that row, and the system will compute the total budget.

For other items you can just enter the total budget amount.

To save your changes on any of the tabs in this page, you can:

- Click Save

- Click Save & Exit

- Click on another tab

The Actual column displays the total of all transactions that are assigned to this budget item whose transaction dates fall within this fiscal year.

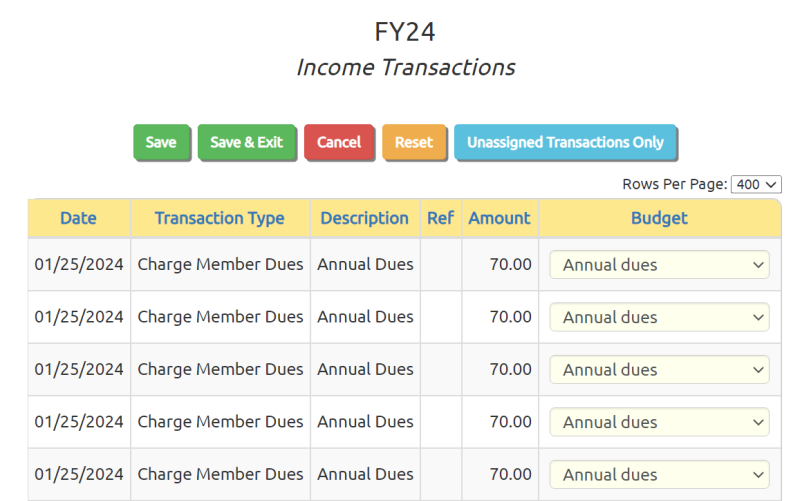

You can assign the budget item for transactions by pressing the Income Transactions button.

This will display all of the income transactions for this fiscal year that are not associated with fundraising events. Use the drop down list in the budget column to select the budget item for each transaction.

Click Unassigned Transactions Only for an easy way to set the budget items for old transactions which were entered without this information.

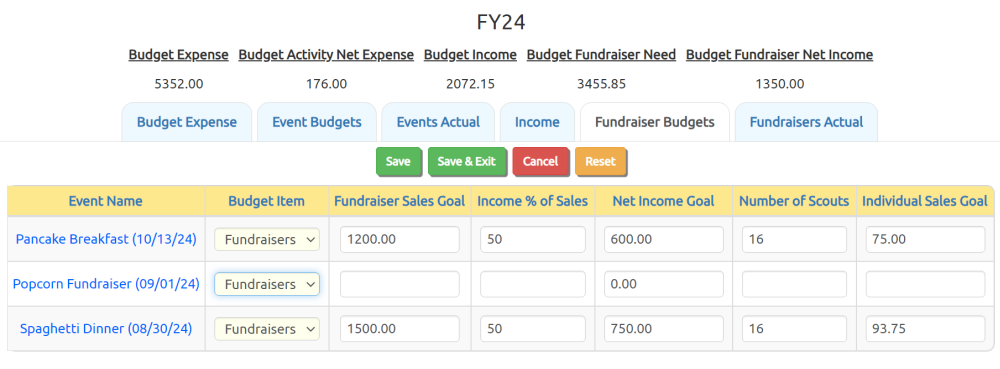

Fundraiser Budgets

The Fundraiser Budgets tab allows you to create a budget for each fundraising event planned for this fiscal year. The budget module assumes that you will create an event on your calendar for every fundraiser.

This is the fifth tab on the Budget page reached from Money → Fiscal Years & Budgets.

If you have already completed your work on the first four tabs, the Budget Fundraiser Need displayed at the top of the page should be the total income needed from fundraisers for this year.

For each fundraiser, you should first select the appropriate Budget Item from the drop down list. This is the budget item into which all of the expenses and income for this event will roll up. The default budget template only has one budget item for fundraisers, so this choice list may only contain one entry.

The Fundraiser Sales Goal should be set to the gross sales goal for this fundraiser.

Income % of Sales is the percentage of the gross sales that you expect the troop to retain as its profit from the fundraiser.

Net Income Goal is the total profit expected from this fundraiser. It will be be automatically computed based on the previous two columns.

The Number of Scouts is the number of scouts you expect to participate in this fundraiser.

The Individual Sales Goal is computed for you. It represents the gross sales needed from each scout to achieve the Fundraiser Sales Goal.

To save your entries:

- Click Save, or

- Click Save & Exit, or

- Click on another tab

Fundraisers Actual

The Fundraisers Actual tab shows you the actual income and expense recorded for each of the fundraising events in this fiscal year.

This is the sixth and final tab on the Budget page reached from Money → Fiscal Years & Budgets.

For each fundraiser, it shows:

- Fundraiser Sales Goal, as set in the Fundraiser Budgets tab.

- Income, from the credit transactions entered for this fundraiser.

- Budget Expense, as computed from the Fundraiser Budgets tab.

- Expense, from the debit transactions entered for this fundraiser.

The View Detail button allows you to see the underlying transactions for this event. From there you can update individual transactions or add new transactions.

Fund Accounting

Fund Accounting is an optional feature of the OurGroupOnline accounting subsystem which we do not recommend for most groups.

Why don't we recommend it?

- We do not think it is necessary for a group's basic bookkeeping requirements

- It will add to the effort required to enter routine transactions

- It can create confusion if not implemented correctly

The fund accounting feature was implemented in response to groups who wished to use the system to allocate and track portions of their funds.

The example we will describe in the following pages is a group that wishes to set aside a certain amount of money to purchase boats and other group equipment for the coming year. This example is implemented in the OurGroupOnline demonstration site.

Setting up fund accounting involves these steps:

- Defining fund categories (optional)

- Defining funds

- Modifying the transaction type table to prompt for these funds

Once you've set this up, you will be prompted for the appropriate fund to debit or credit every time you enter a transaction, depending on the transaction type that you've selected.

You can then produce a report that summarizes your fund balances. You can also view the transactions that contributed to a given fund balance.

Fund Categories

Fund categories are an optional way of grouping funds together for reporting purposes.

If you set up fund categories, the Fund Balances Report will be grouped by those categories.

To maintain fund categories, go to Site Configuration → Fund Categories.

Click Add an Item to begin adding a fund category.

Click Add an Item to begin adding a fund category.

Category is the name you wish to give this group of funds.

Display Sequence is the relative order in which this category should be displayed with respect to other categories.

In our example, we will only have one category: Group Funds

Click Save & Exit to save your work.

Funds

A Fund can represent a subset of the money in your group accounts. To set up your funds, go to Site Configuration → Funds.

Click Add an Item to begin adding a fund.

Click Add an Item to begin adding a fund.

Fund Name will appear on reports that show fund balances.

Description tells what this fund represents.

Category is the optional fund category to which this fund belongs.

Display Sequence is the relative order in which this fund will appear with respect to other funds in this category.

Budget is an optional field that can store the target amount for this fund.

Click Save & Exit to save your work.

For our example, we created four funds, as shown below.

Transaction Types

Transaction Types control the effect of each transaction that is entered into the system.

When you enter a transaction you are required to select a transaction type. This will determine the other information you are required to enter on that transaction.

Your system was initialized with a set of transaction types that are all you need to handle most group's bookkeeping requirements.

Unless you plan to do fund accounting, we recommend that you not make any changes to this table.

To view the transaction types, go to Site Configuration → Transaction Types.

When your system is configured, two of the transaction types will be marked disabled:

- Starting Fund Balance

- Transfer Between Funds

If you are going to do fund accounting, you will need to enable these transaction types.

Click Update to select a transaction type to modify.

Click Update to select a transaction type to modify.

Transaction Type is the name that will appear in the transaction type list when you are entering transactions.

Deposit Date Required determines whether you will be required to enter an additional date - the Deposit Date - when entering this type of transaction. For transactions that can be grouped together for bank deposits, requiring this date will make it easier to reconcile your bank statement.

Event For Which Payment Is Intended should only be selected on "deposit" transaction types which affect an individual's account balance. If this box is checked, when you enter a transaction of this type you will have the option of indicating the event for which this payment is intended. It will not cause the amount to be posted to this event's balance, but will allow you to view which members have made payments that were intended for this event.

Fund Debit Required should only be selected if you are doing fund accounting. If this box is checked, when you enter a transaction of this type you will be required to specify a fund whose balance will be reduced by the amount of the transaction.

Fund Credit Required should only be selected if you are doing fund accounting. If this box is checked, when you enter a transaction of this type you will be required to specify a fund whose balance will be increased by the amount of the transaction.

Fiscal Year should only be selected if you are doing fund accounting. If this box is checked, when you enter a transaction of this type you will be able to enter the fiscal year to which it should apply.

The Disabled box will make this transaction type unavailable when adding or updating transactions. Disabling a transaction type will have no effect on transactions that were already entered using this type.

The rest of the fields on this form will only be modifiable if you have not yet created any transactions that use this transaction type.

Group Debit Required will determine whether you will be required to specify a group account whose balance will be reduced by the amount of this transaction.

Group Credit Required will determine whether you will be required to specify a group account whose balance will be increased by the amount of this transaction.

Person Debit Required will determine whether you will be required to specify a member whose balance will be reduced by the amount of this transaction.

Person Credit Required will determine whether you will be required to specify a member whose balance will be increased by the amount of this transaction.

Event Debit Required will determine whether you will be required to specify an event whose balance will be reduced by the amount of this transaction.

Event Credit Required will determine whether you will be required to specify an event whose balance will be increased by the amount of this transaction.

Click Save & Exit to save your work.

For our Fund Accounting example, we made the following changes:

- On every transaction type where Group Debit Required was set to YES, we set Fund Debit Required to YES

- On every transaction type where Group Credit Required was set to YES, we set Fund Credit Required to YES

- We unchecked the Disabled box on the Starting Fund Balance and Transfer Between Funds transaction types

With the transaction types configured for Fund Accounting as described above:

- When entering most deposits, you would select "General Fund" as the Credit Fund.

- When entering a deposit that was made specifically for equipment (like a donation which was specifically for that purpose), select "Equipment" as the Credit Fund.

- When the group sets aside money to be spent for equipment, use the "Transfer Between Funds" transaction type to move the money from "General Fund" to "Equipment".

- When you purchase equipment for the group, select "Equipment" as the Debit Fund.

- When entering all other expenses, select "General Fund" as the Debit Fund.

You will then be able to view your General Fund and Equipment balances from the Funds page and drill down to the transactions that affected each balance.

You can also print a report showing your fund balances.

Getting Started With Accounting

To set up the accounting for your group:

- Create membership records for every member of your group.

- Decide if you want to use the fund accounting feature and, if so, set up the funds, categories and transaction types

- Create one or more group accounts.

- Enter the starting balance for each group account.

- Enter or upload the starting balance for each member account.

- Enter the starting balance for any event for which the books are still open.

- Enter the starting balance for each fund (only if you are doing fund accounting)

As treasurer, you may not be responsible for the first step, but you must wait until this is complete before you can start. Members are added from the Active Members page.

Create Group Accounts

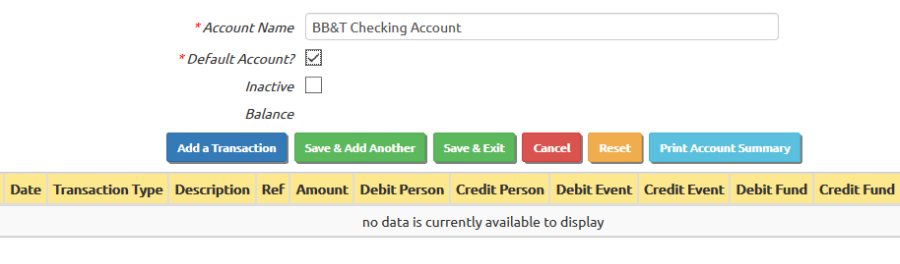

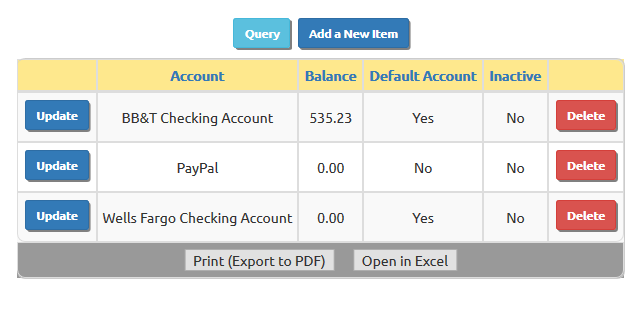

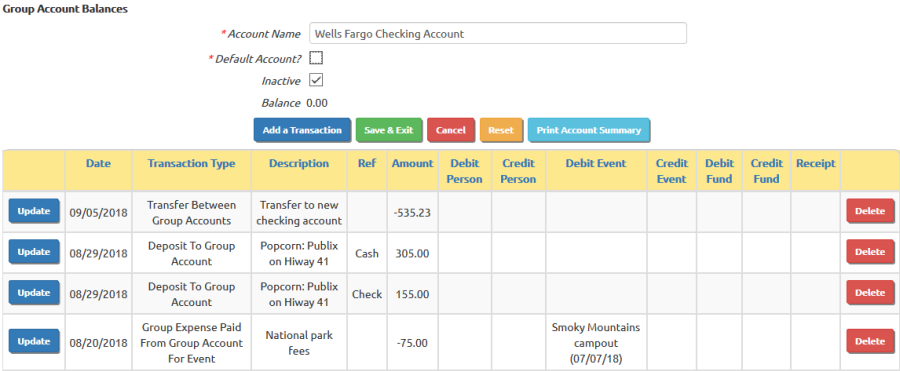

To create your group accounts, go to the Money menu and select Group Account Balances. Click the Add a New Item button to begin creating an account.

You should create one group account for each location where you keep group funds. Specifically, you should create a group account for each location for which you wish to track the current balance. This may or may not include locations like a petty cash drawer, depending on whether you want to record all of your cash transactions into the system. If you are going to accept PayPal™ payments, you should also set up a group account for PayPal.

The Account Name should describe the location briefly but accurately, like this: Wells Fargo checking account

We recommend that you include the name of the bank in your account name; this will make it easier to manage the transition if you ever move to a different bank. We also recommend that you include some other descriptive word, such as checking account, in case you ever create more than one account at that bank.

Check the checkbox labeled Default Account if this is going to be the main account in which you track group funds.

The Inactive checkbox can be used to deactivate this account later if you switch to another bank.

Click the Save & Exit button to save your work, or Save & Add Another to do just that.

Enter Starting Balance For Group Accounts

To

enter the starting balance in each group account, go to Money → Individual Transactions and press the Add a New Item button.

To

enter the starting balance in each group account, go to Money → Individual Transactions and press the Add a New Item button.

Select the transaction type Starting Group Account Balance. As soon as you leave this field, you should see the Credit Group Account field displayed in the middle of the page; all other account fields should disappear. If you do not see Credit Group Account, please go back to the transaction type and reselect it.

The Transaction Date should be the date on which this balance was current. This could be the closing date of your last bank statement.

The Description is optional; it should describe this transaction.

The Reference is also optional; it can be left blank.

The Amount should be the current account balance. Assuming you are not overdrawn, this should be a positive number.

Select the group account for which this is the balance in Credit Group Account.

Click Save & Exit to save this transaction.

Starting Balance For Group Members

If members of your group already have money on account with the group - or if they owe the group for past events - you will need to create a monetary transaction for each member to record his/her starting balance. These balances can be uploaded from a spreadsheet, or you can enter them one at a time, as shown below.

To enter individual starting balances, go to Money → Individual Transactions and press the Add a New Item button.

To enter individual starting balances, go to Money → Individual Transactions and press the Add a New Item button.

Select the transaction type Starting Member Account Balance. As soon as you leave this field, you should see the Credit To Person field displayed in the middle of the page.

If the member currently owes the group money, the amount should be a negative number, like this: -42.00.

If the member current has a surplus in his account, the amount should be positive, as shown at left.

Click Save & Add Another to move on to the next account.

Starting Balance For Events

This is an optional step, and is only needed for recent events for which you have not yet finished the accounting.

Select the transaction type Starting Event Balance.

As soon as you leave this field, you should see the Credit Event field displayed in the middle of the page.

Select the transaction type Starting Event Balance.

As soon as you leave this field, you should see the Credit Event field displayed in the middle of the page.

If this event has accumulated more income than expenses - perhaps a fundraiser - the amount should be a positive number.

If this event has more expenses than income - like a banquet that has not yet been charged back to the participants - the amount should be a negative number.

This transaction will not affect the balance of any group account. It just creates an initial balance for the selected event.

Click Save & Exit to save this transaction.

Starting Balance For Funds (Optional)

This is an optional step that you would only do if you are using the fund accounting feature.

Select the transaction type Starting Fund Balance.

As soon as you leave this field, you should see the Credit Fund field displayed in the middle of the page.

Select the transaction type Starting Fund Balance.

As soon as you leave this field, you should see the Credit Fund field displayed in the middle of the page.

If this fund has accumulated more income than expenses, the amount should be a positive number.

If this fund is currently in arrears, the amount should be negative.

Click Save & Exit to save this transaction.

Create one transaction for each fund that has a balance.

Upload Individual Account Balances with CSV Files

If your group has been using a spreadsheet to track member accounts, you may be

able to upload their starting balances into OurGroupOnline electronically.

If your group has been using a spreadsheet to track member accounts, you may be

able to upload their starting balances into OurGroupOnline electronically.

This will create a separate Starting Member Account Balance transaction for each member of your group.

You must have already loaded all of your membership records into OurGroupOnline before using this function.

The first row of the spreadsheet should contain the column names, spelled exactly as shown below:

- LastName

- FirstName

- CurBal

Every subsequent row should contain a member's last name, first name, and current balance.

Be sure to save your spreadsheet as a CSV (comma separated values) formatted file.

Upload To OurGroupOnline

In OurGroupOnline, go to the Money menu and select Upload Account Balances From Spreadsheet.

You should see the screen shown here:

Click the Browse button to find the CSV file that you created.

Set the Effective Date to the date on which these balances were current. This will be the transaction date for each of the Starting Member Account Balance transactions that will be created by this upload.

Click the Upload Accounts File button to post the file.

The system will only create transactions when it finds an exact match on the member's first and last names. It will not create a transaction for a member who already has a Starting Member Account Balance transaction.

When it completes the upload, it will display a list of those names in the CSV file for which it could not find a matching record in OurGroupOnline.

Individual Transactions

Select Individual Transactions from the Money menu to view all transactions and enter new transactions.

This grid shows the most recent transactions in your database. Use the Query button to filter the list.

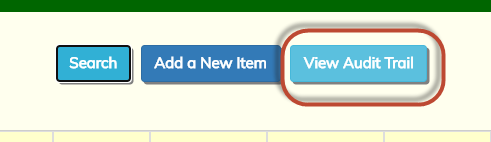

Click Update to update that row; click Delete to delete that row. Click View Audit Trail to view a history of changes to transactions.

Click Add a New Item to enter a new transaction.

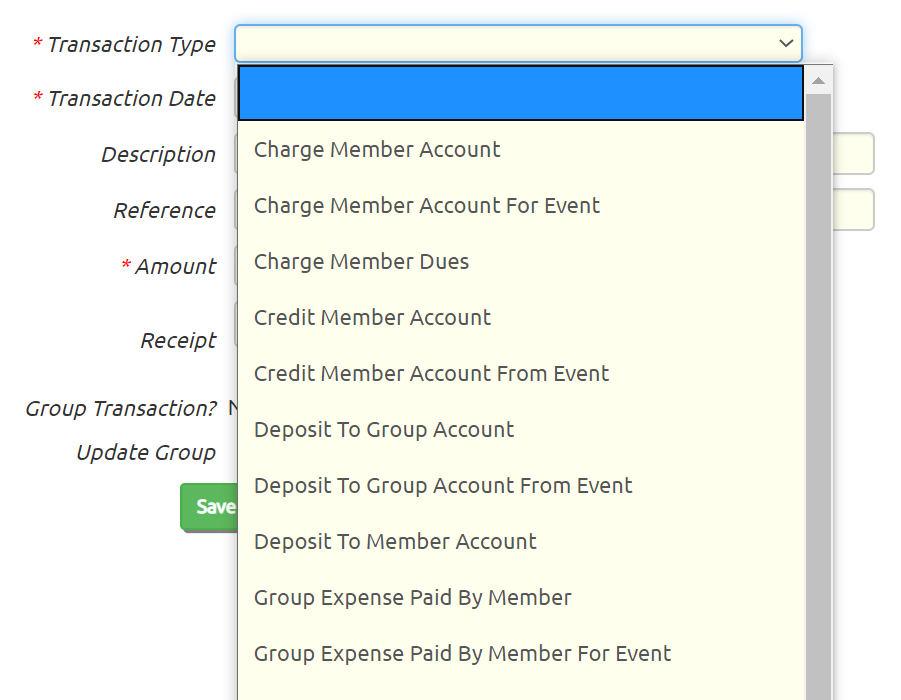

Click on the Transaction Type field to view a list of the available transaction types, as shown above.

Each transaction type describes its effect on group, member, and/or event accounts.

After you select a transaction type and use your mouse or tab key to move to another field, you will see one or more account selection boxes appear. The transaction type determines which fields are needed for the current transaction. This tells you what the effect of this transaction will be.

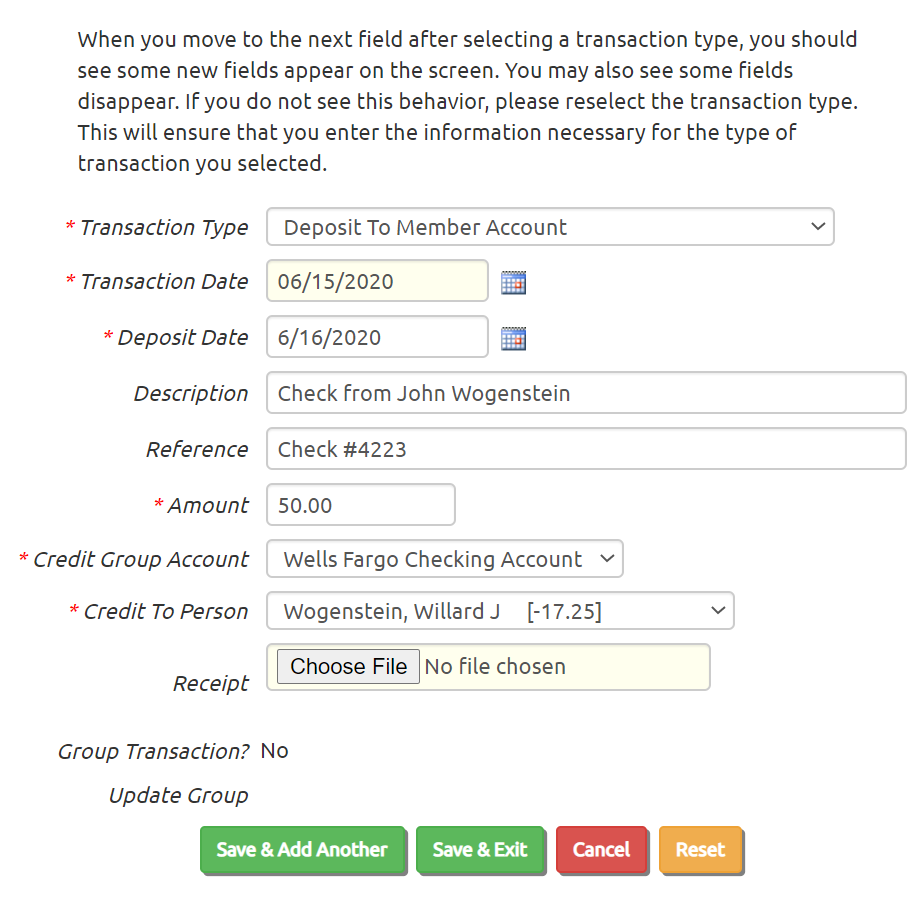

In the example shown below, the selected transaction type requires you to select a group account and a person, each of which will have its balance increased by the amount of the transaction.

The Description field describes this transaction. If this transaction affected a member's account, they will see this description when they view their transaction history.

Reference can be the check number, or if you used the group debit card, just enter "debit".

The Amount will always be a positive number, unless you are trying to reverse the effect of an earlier transaction.

Click Save & Add Another to save this transaction and add another.

This is an easy way to quickly enter a series of transactions.

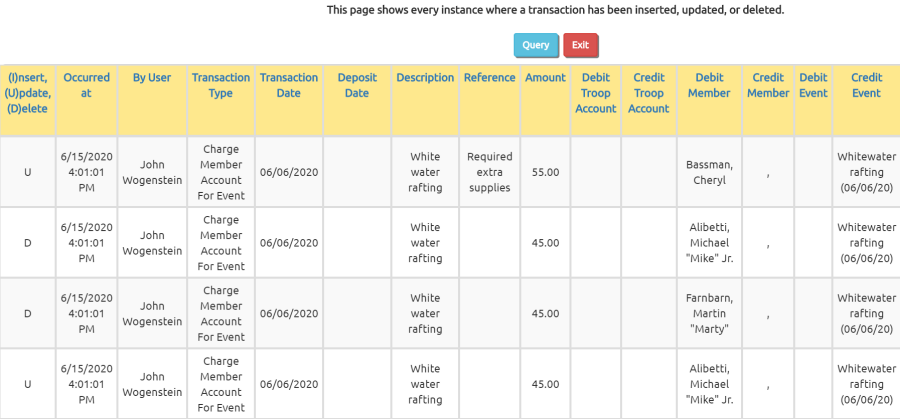

Transaction Audit Trail

OurGroupOnline saves a copy of each transaction every time a transaction is inserted, updated or deleted.

You can view this audit trail by going to the Individual Transactions page and clicking the View Audit Trail button at the top of the page.

This will display the most recent activity at the top of the grid.

Use the Query button to filter the list to find what you're looking for.

Use the Open In Excel button at the bottom of the grid to export this information to an Excel spreadsheet.

The audit trail for an individual transaction is displayed when you select that transaction from the Individual Transactions page.

Group Transactions

Group Transactions provide an easy way to quickly enter the same transaction for a group of members.

This comes in handy for:

This comes in handy for:

- Charging dues

- Charging members for their share of an event

- Crediting members for their share of a fundraiser

Select Group Transactions from the Money menu.

Then select Add a New Item to see the page shown at right.

The top part of the screen is similar to the Individual Transactions entry page.

Select the appropriate transaction type, then enter a transaction date, description, reference, and amount.

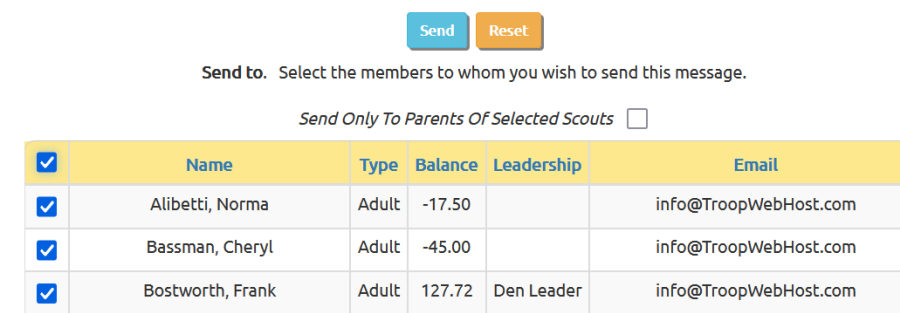

Then select the members for whom you wish to create this transaction by clicking in the checkbox next to their name in the list in the lower portion of the page.

Click on the checkbox in the header row of the grid to select all members. Click it again to unselect all members.

If a particular member should be charged a different amount, you can enter that amount in the Override Amount column.

Click the Save & Exit button when you are ready to create the transactions.

Group transactions will appear in the Individual Transactions grid, but they cannot be modified from that page. You must return to the Group Transactions page to make any changes.

To delete a transaction that was spawned by a Group Transaction, you must return to the Group Transactions page and uncheck that member's name from the list.

Automatically Charge Event Participants

TroopWebHost can be configured to automatically charge members when they sign up for an event. This will cause up to three group transactions to be generated for that event: one for scouts, one for adults, and one for guests.

You can specify a different amount to charge per person for scouts, adults, and guests.

If an event is configured to auto-charge participants, the associated group transactions will be updated automatically as the event and event participants change, until attendance is finalized for the event by checking the Attendance Finalized box on that event. Do not attempt to update these group transactions directly in any way until attendance is finalized, since your changes may be undone by the auto-charge logic.

To be absolutely clear, do not try to edit the group transactions that were generated by the auto-charge feature until attendance is finalized for the event.

One other thing: you should always take attendance for any event that has the auto-charge feature enabled.

Setting Up An Event To Automatically Charge Participants (step 1)

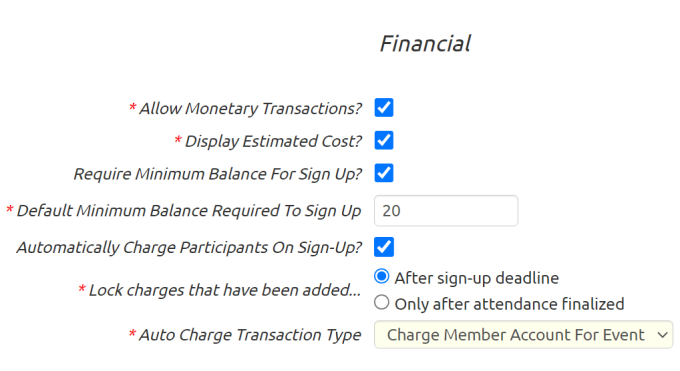

First you must configure one or more Event Types to support this feature. To do this, go to Site Configuration → Event Types. Update an event type for which you want to enable auto-charging, then scroll down the page to the "Financial" section.

You must have Allow Monetary Transactions enabled to auto-charge participants.

Then check the box for Automatically Charge Participants On Sign-Up. This will cause additional fields to be displayed, all of which are required.

Lock charges that have been added... determines when the system will stop automatically removing the charges for members who signed up for an event earlier, but later withdrew. If you choose "After sign-up deadline", then members who withdraw after the sign-up deadline will still be charged for the event. Regardless of which option you select, no changes to participant charges will occur automatically after attendance has been finalized for the event.

Auto Charge Transaction Type. Select the transaction type to be used when the system generates group transactions to charge the participants on an event.

Auto Charge Fund To Debit. If the selected transaction type is configured to debit a fund, select the fund to be automatically debited when participants are automatically charged.

Auto Charge Fund To Credit. If the selected transaction type is configured to credit a fund, select the fund to be automatically credited when participants are automatically charged.

Setting Up An Event To Automatically Charge Participants (step 2)

Once you have configured the event type to support auto-charging participants, you are ready to set an upcoming event to auto-charge participants.

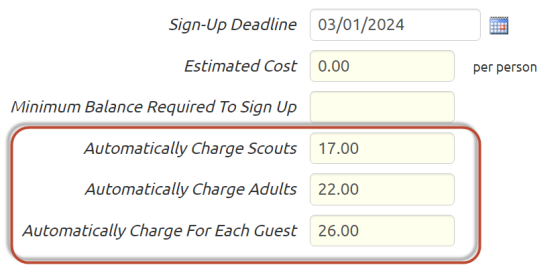

Go to Calendar → Add & Update Events and update an event that has an event type for which auto-charging is enabled. On the Event Details tab, scroll down to find the Automatically Charge fields, shown circled below.

All of the auto-charge fields are optional. If you leave them all blank (or zero), nobody will be automatically charged when they sign up for the event.

If you want to only auto-charge scouts, you can leave the adult and guest fields blank, and just enter the amount you want to charge scouts. Similarly, if you only want to auto-charge adults, just leave the other fields blank.

Once you enter values into any of these three fields and save your changes, the system will generate the appropriate group transactions.

The group transaction for scouts will have each scout who signed up for the event automatically selected. The group transaction for adults will have each adult who signed up for the event selected. The group transaction for guests will have any member who has one or more guests.

But what about those other fields that are also about money and charges?

Estimated Cost is just a comment. You may leave it blank, or you can enter text that describes how you've set the auto-charge values.

Minimum Balance Required To Sign Up does not have to match the amount (if any) you entered to automatically charge scouts. If a member's balance is less than the minimum required for the event, they will not be able to sign up for the event, and thus will not be automatically charged.

Event Sign Up And Withdrawals

Once an event is configured for auto-charging, as shown above, any scout who signs up for the event will be added to the scout group transaction for that event. Any adult who signs up for the event will be added to the adult group transaction for that event. And anyone who signs up for guests will be added to the guest transaction for that event.

Anyone who withdraws from the event will be automatically removed from the group transactions for that event - unless:

A) The sign-up deadline has passed, AND the "Lock charges that have been added..." option on the Event Type was set to "After sign-up deadline", or

B) Attendance has been finalized for the event.

Once attendance is finalized, all of the automatic updates to the group transaction will stop. Only then is it safe to edit the group transactions directly.

Finalizing Attendance

You should always finalize attendance on any event that is configured to automatically charge participants. This will lock the existing group transaction so that it is no longer affected by changes in the participation status for this event. You can still modify the charges by editing the group transactions that were created by the auto-charge feature, which will allow you to add and remove members from the transaction and override the amount.

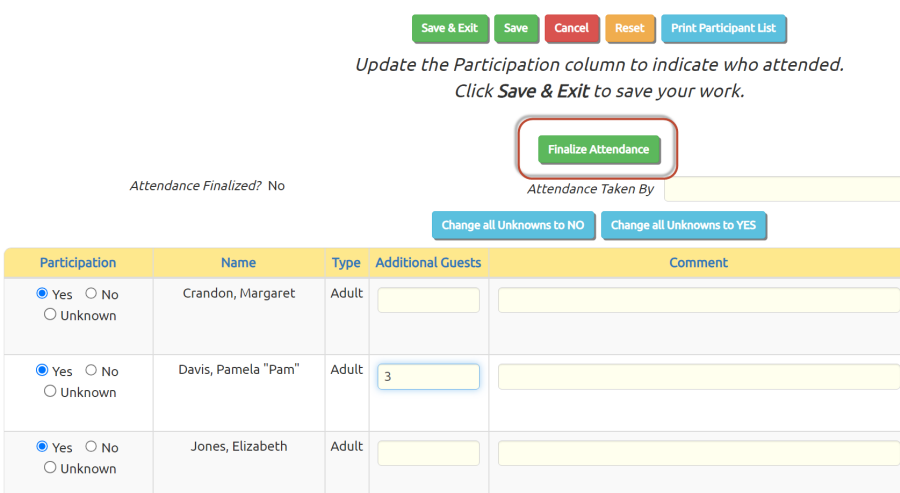

Use the Take Attendance page to finalize attendance. It is available from the main menu at Calendar --> Take Attendance --> Take Attendance. Update the participation status of each member to accurately reflect what happened, then click the Finalize Attendance button, as circled below.

If the event was configured to automatically charge participants, finalizing attendance will cause the Take Attendance page to be locked; it will not allow you to make any further changes in the participation status for this event.

However, authorized users will still be able to make changes to attendance from the Maintain Events page on the "Sign-up List" tab. But once attendance has been finalized for an event, further changes will NOT affect the billing for this event.

Accounting For Deposits

There are three types of deposits::

- Deposit to a Member Account

- Deposit to a Group Account

- Deposit to a Group Account from a Fundraiser

Deposit To Member Account

Deposit To Member Account

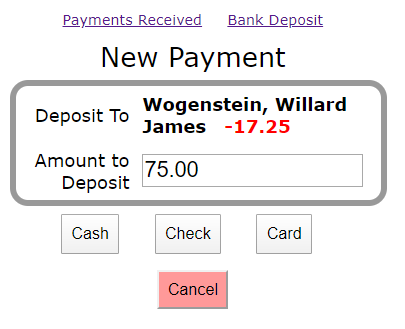

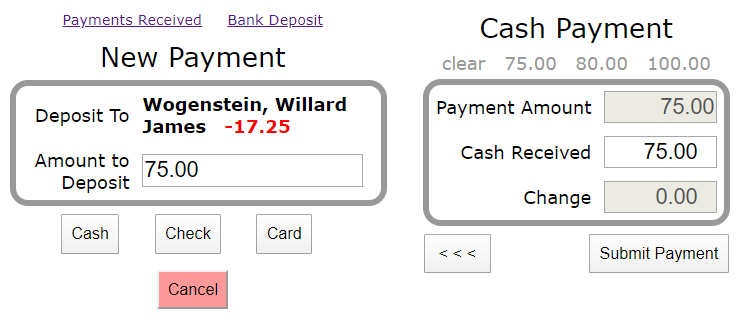

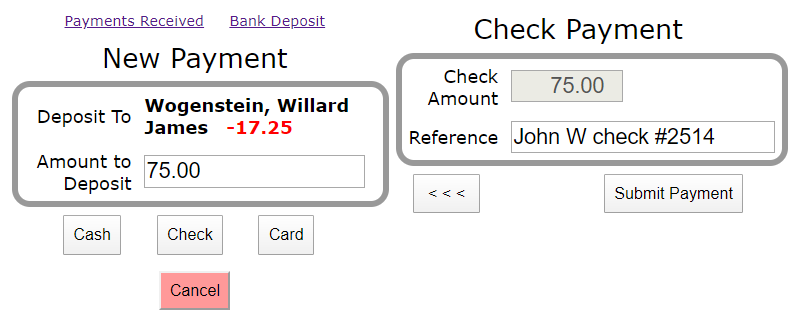

The example on the left shows a deposit to a member account.

This is how you should handle any funds received from a group member, regardless of whether the purpose is to pay for past expenses or to add to their account to cover future expenses.

The Transaction Date is the date you received this payment from the individual.

The Deposit Date is when you expect to deposit this payment in your group bank account.

Credit Group Account should be set to the bank account to which you plan to deposit this payment.

This payment will also credit this member's account, which you select under Credit To Person.

If you are doing fund accounting, you should also select the Credit Fund whose balance will be increased by the amount of this deposit.

Deposit To Group Account

Sometimes your group will receive funds from an outside source, like a donation.

When these funds are deposited, they should only credit the group account, not any individual members.

As shown at right, use a Deposit To Group Account transaction to record this deposit.

Deposit To Group Account From Fundraiser

When you receive funds from a fundraiser, those deposits should be posted both to your group checking account and to the fundraising event.

Use the Deposit To Group Account From Event transaction type to record this deposit, as shown at left.

Noting Payments For Events

As seen on the previous page, when you deposit funds to a member's account it increases the balance of that member's account and to the selected group account.

In some cases, you may wish to also indicate the event for which the payment was intended. This will not affect the balance of that event, but will allow you to indicate the intent to use this payment to cover the cost of that event.

If you want to configure your system to allow this, start by modifying the deposit transaction types that credit a person's account, like "Deposit To Member Account".

Check the box labeled Event For Which Payment Is Intended, then click Save & Exit to save your work.

This will cause these transaction types to prompt for Payment Intended For Event as shown below.

If you have configured your site to accept PayPal payments, if you make this change to the transaction type associated with PayPal payments it will cause the On-Line Payments page to display an additional prompt as shown below.

The other configuration steps have to do with the security configuration for the users who should be allowed to see member balances when viewing the participants for an event.

Even if you do not choose to configure your transaction types as described above, you may still want to make the first of these changes.

Select Assign Tasks To Roles from the Security Configuration subment of the Administration menu, then scroll down the list until you find the authorized task named "View Participant Individual Balances on Event", as shown below. Click on the Assign To Roles button for that item.

Check the boxes next to the user roles that should be allowed to see member account balances when viewing the participants on an event.

When the users who have been assigned these roles select an event from the Calendar and scroll down to view the participants, they will now see each participant's current balance.

If your group has a policy requiring members to have a positive balance to be allowed to attend an event, this can help you enforce that policy.

If you have configured your deposit transactions to allow the selection of the event for which the payment was intended, there is one more configuration step.

Select Assign Tasks To Roles from the Security Configuration subment of the Administration menu, then scroll down the list until you find the authorized task named "View Participant Payments Toward Event", as shown below. Click on the Assign To Roles button for that item.

Check the boxes next to the user roles that should be allowed to see each member's total payments designated for this event when viewing the participants on an event.

When the users who have been assigned these roles select an event from the Calendar and scroll down to view the participants, they will now see the participants' payments for that event.

We recommend that you review your group's policies regarding payments and event participation before implementing these changes.

How will you handle a situation where a member has made a payment toward an event, but currently has a negative balance overall? Should the member still be allowed to attend that event?

Dues

Many groups charge their members annual or monthly dues.

These funds help the group cover on-going expenses.

Many groups charge their members annual or monthly dues.

These funds help the group cover on-going expenses.

With OurGroupOnline, dues can be charged to the members' accounts. This transfers money from their individual account to the group.

The best way to do this is by creating a Group Transaction.

Go to Money → Group Transactions and click Add a New Item to begin.

Select Charge Member Dues as your Transaction Type.

Enter the beginning of the month (or week) as your Transaction Date.

Enter something like "February Dues" as your Description.

Enter the amount of the dues being collected from each individual member in the Amount field.

Click on the checkbox in the header row of the grid to select all members, or select individual members by clicking on the check box next to their names.

Then click the Save & Exit button when you are ready to create the transactions.

Transfer Funds

From time to time you may need to transfer money between accounts. This can take three forms:

- Transfer money from one individual member to another

- Transfer money from one group account to another

- Transfer money from one fund to another

Transfer Between Members

Transfer Between Members

If a family has several members in the group, they may ask you to rebalance their accounts by shifting money from one to another.

You can do this by using the Transfer Between Member Accounts transaction type, as shown at left.

Select the person from whom the money is being transferred as the Charge To Person account.

Select the person who will receive the money as the Credit To Person.

Transfer Between Group Accounts

Transfer Between Group Accounts

If your group has more than one group account, you may need to occasionally move money from one to another.

In the example shown at right, money was transferred from the group's PayPal™ account to its checking account.

Transfer Between Group Funds

Transfer Between Group Funds

If you are doing fund accounting, you may need to occasionally move money from one fund to another.

In this example, the group set aside $500 to use for future equipment purchases.

Accounting For An Event

Accounting for an event can involve these steps:

Accounting for an event can involve these steps:

- Estimate the cost per participant and post it to the event in advance

- Enter the expenses associated with the event

- Charge the cost to the participants

Some groups wait until after the event to determine the total expenses that were incurred, and then charge the actual cost back to the participants.

Other groups estimate the cost in advance and charge that amount to everyone who signed up.

OurGroupOnline can support either approach.

Post Estimated Cost

If it is possible to estimate the cost of an activity in advance, you can include that information on the Event record. Your group will appreciate knowing the cost when they sign up.

Go to Events → Add & Update Events. If you do not have access to this function, ask your site administrator to post this information for you.

Select the event you wish to update. You should see a page like the one shown at left.

Enter the estimated cost into into the Estimated Cost field and click Save & Exit to save your work.

The estimated cost does not have any impact on any accounts. It is for informational purposes only.

Enter Expenses

Enter Expenses

Some group expenses will be paid directly out of your group checking account, either by check or debit card. This includes items purchased by members who were reimbursed directly by check.

To enter these transactions, go to Money → Individual Transactions and click Add an Item.

Select Group Expense Paid From Group Account For Event as your transaction type, as shown at right.

The Transaction Date should be the date the purchase occurred, not the date of the event.

Select the appropriate group account as the Debit Group Account, and select the event from the Debit Event selection box.

Click Save & Exit to save your work, or Save & Add Another to keep on going.

Expenses

can also be incurred by members who would like the amount to be credited to their personal account.

Expenses

can also be incurred by members who would like the amount to be credited to their personal account.

The next sample on your right shows how to create this type of transaction.

Select Group Expense Paid By Member For Event as your transaction type.

Select the person who incurred the expense in Credit To Person, and select the event from the Debit Event selection box.

This will increase the balance in this person's account and charge it to the event. It will not affect any group account balances.

Charge The Participants

If your group charges back the actual cost of the event to the participants, you need to start by determining the total expenses incurred.

Go to Money → Event Balances to view a list of all events. Click View Details to see a page like the one shown below.

Verify that all of the expenses are accounted for, and then use this information to calculate the cost per participant.

Once you know the charge per person, you need to create one transaction for each participant.

Once you know the charge per person, you need to create one transaction for each participant.

The easiest way to do this is by creating a Group Transaction.

Select Group Transactions from the Money menu.

Then select Add a New Item.

You should see a page like the one shown at right.

Select Charge Member Account For Event as your Transaction Type.

The Transaction Date should be the date of the event.

The Description should include the name of the event.

The Amount should be the amount to charge each participant.

Select the event from the Credit Event selection box.

Then put a checkmark next to each group member who attended.

Click Save & Exit to create a transaction for each of the selected individuals.

If you now return to the Event Balances page you will see that these charges have been posted to the event as income.

The balance for the event should now be close to zero.

Accounting For A Fundraiser

Many groups hold fundraisers

to support their activities.

Many groups hold fundraisers

to support their activities.

Some sell candy door to door, others hold bake sales and garage sales, and some even sell Christmas trees.

Each of these fundraising activities should be entered as an Event on your calendar.

You can then post expenses and income to that event.

When you have everything tallied, you can distribute the proceeds to your members if that is your policy, or retain the funds for use by the group as a whole.

Create The Event

Go to Activities → Add & Update Events to create the Event record for your fundraiser. If you do not have access to this function, ask your site administrator to post this information for you.

As shown above, the Event Type should be set to Fund Raiser.

For one day events, the Scheduled Start and Scheduled End times should be just that.

For fundraisers that span several weeks - like Christmas Tree Sales - you could have the Scheduled Start be the opening day and the Scheduled End be the final day. This will cause the event to show up on your calendar every day between those two dates.

If that's not to your liking, you could just set both dates to be the final day of the fundraising event. If you take that approach, you might want to set the description to something like Christmas Trees - Final Day To Report Sales.

Enter Income

As the money rolls in, record your bank deposits using the Deposit To Group Account From Event transaction type.

The Deposit Date should be the day you made the deposit, so it matches your bank statement.

Select the fundraiser as the Credit Event, as shown at right.

Enter Expenses

The expenses you incur for a fundraiser should be posted to that event.

Choose one of these transaction types for the expenses:

- Group Expense Paid From Group Account For Event if the expense was paid for directly from a group account

- Group Expense Paid By Member For Event if an individual member paid for it and wanted it credited to his account

Be sure to select the fundraising event as the Debit Event.

View Your Net Profit

After you've recorded all of the income and expenses for this fundraiser, it's time to see what you made.

Go to Money → Event Balances to view a list of all events. Click View Details for your fundraiser to view a page like the one shown below.

You should see all of the income and expenses in the grid at the bottom of the page. Verify that nothing is missing.

The summary at the top of the page shows you the Total Income and Total Expense for the fundraiser.

The Balance is your net profit.

Distribute The Proceeds

If you plan to distribute some or all of the profits from the fundraiser to members of your group, do so using the Credit Member Account From Event transaction type.

This will increase the balance of that member's account.

If the amount is different for each group member - which could be the case if you base your distribution on number of hours worked or total sales - you will need to enter individual transactions as shown at right.

If the same amount is being distributed to all participants, you can easily enter all of the distributions at once by entering a Group Transaction.

Accepting On-Line Payments

OurGroupOnline allows you to configure your site to accept on-line payments from scouts and their parents. Your members can initiate these payments from the On-Line Payments page. Once they complete a payment it will be automatically posted to their account.

OurGroupOnline currently supports two on-line payment vendors:

- Square™ allows you to accept on-line payments via ACH, credit and debit cards.

- PayPal™ allows you to accept on-line payments from PayPal accounts as well as via credit and debit cards.

If you like, you can offer both options to your users, and let them decide which they prefer. Or you can keep it simple and just choose whichever vendor you are most comfortable with.

You will need to set up an account with each vendor before you can accept payments using their service. This will be done on that vendor's website, and will involve providing them the bank routing information for your troop's checking account where you plan to deposit the funds.

The benefits of using Square include:

- Easy initial set up

- Fast, convenient payment process for your users

- All payments are automatically transferred to your troop's checking account within 2 business days

- Option of accepting ACH bank transfers, which have a significantly lower fee for large payments

- Accept in person payments to member accounts using the Payment Collector

The benefits of using PayPal include:

- Option to make payments directly from a user's PayPal account

- Lower processing fee if you can provide documentation to PayPal of your charter organization's 501(c)(3) status

- Payer receives an email receipt from PayPal after each payment

Setting up your site to use PayPal is a bit more complicated than Square, but we will walk you through the process in the next few pages.

Square is a bit easier to configure, which you can learn about here.

Accepting Payments On-Line With PayPal™

OurGroupOnline makes it easy for your group to accept payments from members on-line using PayPal™.

OurGroupOnline makes it easy for your group to accept payments from members on-line using PayPal™.

Some important facts before you get started:

- Your group must have a PayPal™ business account (there is currently no charge for this).

- Members do NOT need to have a PayPal™ account to use this function.

- PayPal™ will deduct their usual fees from most payments.

- OurGroupOnline does not receive any portion of those fees.

- OurGroupOnline is not involved in the actual transfer of funds.

When a member wants to make a payment to the group using PayPal™, they begin by selecting On-Line Payments from the My Stuff menu. This allows them to indicate the amount of the payment and the account to which it should be deposited.

The system then takes them to the PayPal™ website to make the payment.

When the payment is approved, we receive notification from PayPal™ and a transaction is created to post the deposit to the member's account. The deposit is also posted to your designated group account.

To set up your group to accept PayPal™ payments, you will need to:

- Set up a business account at PayPal, if your group does not already have one.

- Log on to your group's account at the PayPal website. From there you will need to:

- Find and copy your PayPal Merchant ID.

- Find the current balance of your PayPal™ account.

- Set the IPN Listener URL to point to OurGroupOnline.

- Create a Group Account for your group's PayPal™ account and set the starting balance.

- If desired, create a Transaction Type specifically for PayPal™ deposits.

- Fill out the PayPal Configuration form.

- Assign the Make On-Line Payment task to all User Roles

Your treasurer can receive an e-mail whenever a PayPal™ transaction is processed.

Authorized users can view recent PayPal™ transactions and see the status changes on each.

The next few pages will show you how to set up your group to use PayPal™.

Finding Your PayPal™ Merchant ID

If your group wants to accept payments on-line, you will first need to set up a business account at PayPal™,

by going to their web site at www.PayPal.com

If your group wants to accept payments on-line, you will first need to set up a business account at PayPal™,

by going to their web site at www.PayPal.com

If your group qualifies as a 501(c)(3) tax exempt organization, you can obtain a lower transaction rate if you provide PayPal™ with the necessary documentation.

PayPal™ will require you to identify and confirm your group's checking account, a process that may take several days to complete.

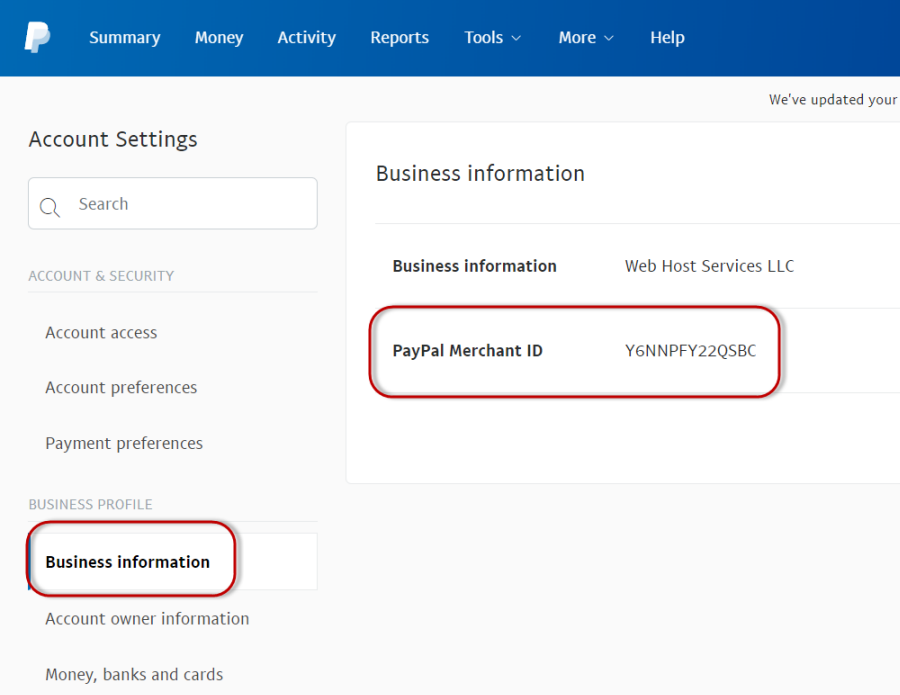

Once you have a PayPal business account, the next step is to identify your PayPal Merchant ID.

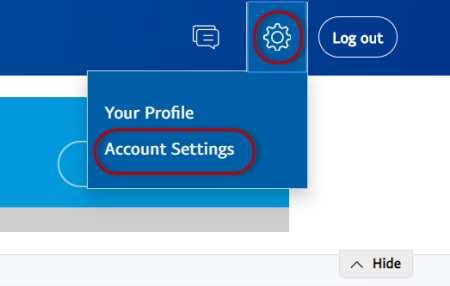

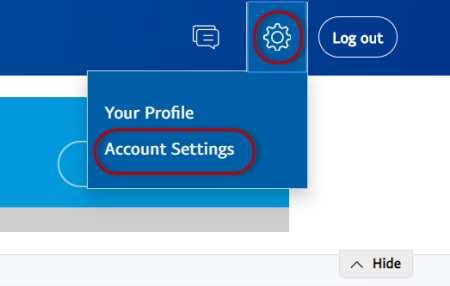

While you are logged on to the PayPal™ web site,

click on the cog icon in the upper right corner to open the Profile menu.

Then select "Account Settings" from that menu. This will open a new page.

While you are logged on to the PayPal™ web site,

click on the cog icon in the upper right corner to open the Profile menu.

Then select "Account Settings" from that menu. This will open a new page.

Click Business Information on the menu on the left to display your PayPal Merchant ID, as shown below.

You will need to know this Merchant Account ID when you get to the PayPal Configuration page later on, so make a copy of this value.

You should also note the current balance of your PayPal™ account for when you set your starting balance.

PayPal™ Instant Payment Notification URL

PayPal™ offers a service called Instant Payment Notification, or IPN, which can electronically notify a payment recipient with the status

of a transaction.

PayPal™ offers a service called Instant Payment Notification, or IPN, which can electronically notify a payment recipient with the status

of a transaction.

This service requires the recipient to have a "listener" page to which PayPal™ can send these notifications. OurGroupOnline has a listener page that will use these notifications to update your database.

You need to tell PayPal™ where to find this page.

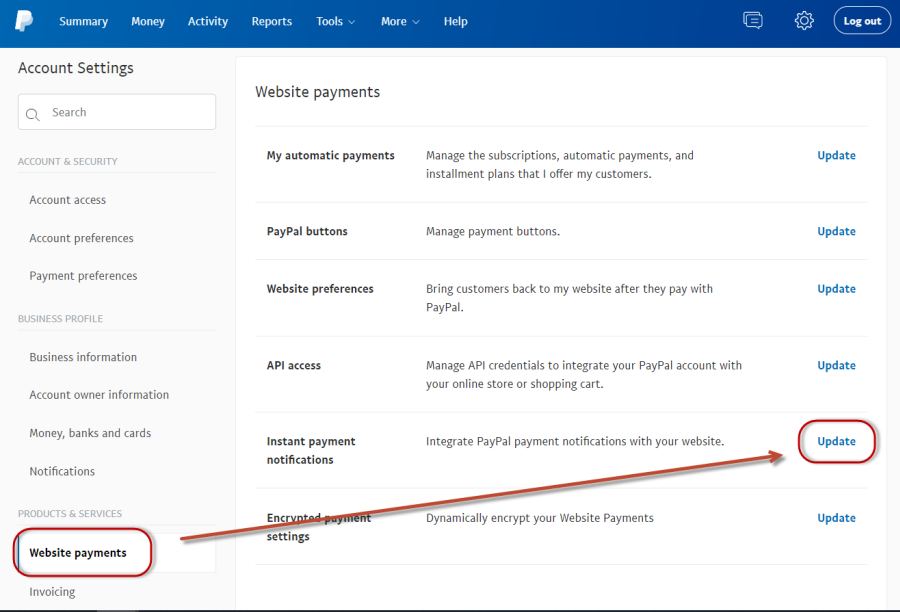

While you are logged on to the PayPal™ web site,

click on the cog icon in the upper right corner to open the Profile menu.

Then select "Account Settings" from that menu. This will open a new page.

While you are logged on to the PayPal™ web site,

click on the cog icon in the upper right corner to open the Profile menu.

Then select "Account Settings" from that menu. This will open a new page.

Click Website payments on the menu on the left. When this page displays, look for "Instant payment notifications" and click the Update button on that row, as shown below.

You should then see the page shown below.

Copy the following text into the Notification URL field:

https://www.OurGroupOnline.org/PaypalProcessStatus.aspx

Click on the radio button labeled Receive IPN messages (Enabled)

Then click the Save button to save your changes.

You are done with the PayPal™ part of this process.

Configuring Your Site For PayPal™

Once you've obtained your PayPal Merchant ID and set your PayPal Instant Payment Notification URL, you are ready to configure your OurGroupOnline site to communicate with PayPal™.

First, set up a Group Account to represent your PayPal™ account. This will allow you to use Statement Reconciliation to monitor the deposits and withdrawals from this account.

If your PayPal™ account currently has a non-zero balance, enter a Starting Group Account Balance for this account from the Individual Transactions page.

You may also want to create a special Transaction Type to be used specifically for PayPal™ deposits. If you do this, we recommend the following settings:

| Transaction Type: | PayPal Deposit To Member Account |

| Deposit Date Required? | no |

| Fund Debit Required? | no |

| Fund Credit Required? | depends on whether you are using fund accounting |

| Group Debit Required? | no |

| Group Credit Required? | YES |

| Person Debit Required? | no |

| Person Credit Required? | YES |

| Event Debit Required? | no |

| Event Credit Required? | no |

Next, select PayPal Configuration from the Site Configuration menu. This will display a page containing the following entries:

The Business ID of PayPal Account is the PayPal Merchant ID that you copied from the PayPal™ site earlier.

Choose the PayPal Account Type that matches your PayPal™ account. To qualify for the non-profit rate you must provide PayPal™ with documentation of your charter organization's 501(c)(3) status. NOTE: Simply selecting this option here will not get you the lower rate! You must contact PayPal to obtain this rate.

The PayPal Group Account is the Group Account you just created to represent your PayPal™ account. All PayPal™ payments will be credited to this account.

The Fund for PayPal Deposits is optional; if you are using fund accounting you can specify a fund to which all PayPal™ deposits will be credited.

The PayPal Deposit Transaction Type is the transaction type that will be assigned to all PayPal™ payments. If you created a new Transaction Type as described above, select that one here; otherwise, choose Deposit To Member Account.

Email Address for PayPal Notifications should be the treasurer's e-mail address. An e-mail will be sent to this address each time a PayPal™ notification is received.

By default, the transaction fee which is charged by PayPal will be deducted from the amount deposited to the member's account. So, for example, if a member pays $100 and the PayPal fee is $3.20, only $96.80 will be deposited to the account.

Your group may choose to absorb this fee, which may encourage more members to make on-line payments. If you check the box Group Absorbs PayPal Fee For Member Payments, a member who pays $100 will see $100 deposited to his account, while the group will incur an expense of $3.20.

If you check the box Group Absorbs PayPal Fee For Member Payments, you will need to select a Transaction Type For PayPal Fee Absorbed By Group. This will be the transaction type that will be used to record the expense of the PayPal transaction fee when the group absorbs the fee.

If the selected transaction type requires a fund to debit, you must select a fund from the drop down list for Fund To Charge PayPal Fee.

Click Save to save your work.

Add On-Line Payments To The "My Stuff" Menu

The last step in configuring your site to work with PayPal™ or Square™ will add the On-Line Payments selection to everyone's My Stuff menu.

Go to Site Configuration → Security Configuration → Assign Tasks To Roles to see a page like the one shown below.

Scroll down this page until you see the entry for Make On-Line Payments. Click the button Assign To Roles to update this task, as shown below.

Check all of the boxes, then Save & Exit.

You should now see On-Line Payments on your My Stuff menu.

You are ready to use PayPal™ or Square™.

Accepting Payments On-Line With Square™

Square™ is somewhat easier to set up than PayPal™ and also provides a faster way to accept payments.

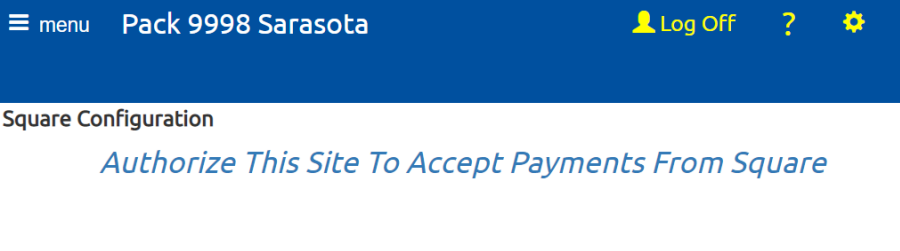

To configure your site to accept payments via Square, please go to Site Configuration → Square Configuration.

The first time you visit this page it will look like this:

Click on the link that says "Authorize This Site To Accept Payments From Square" to begin the process.

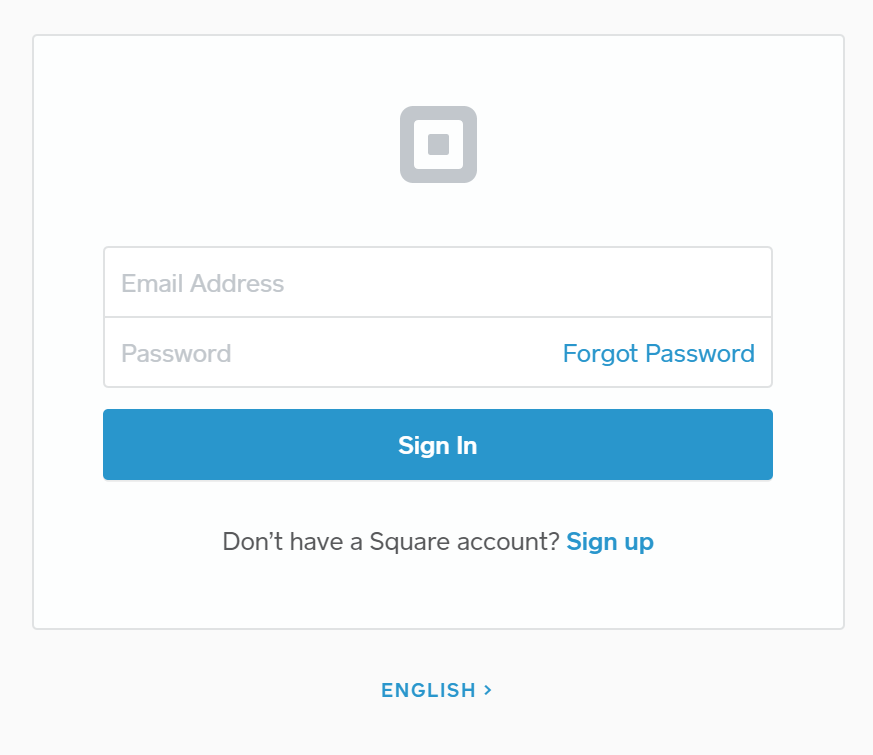

This will take you to a page that looks like this:

If your group already has an account with Square, you can log on to that account from here.

If you do not yet have a Square account, you can create one by clicking the "Sign Up" link.

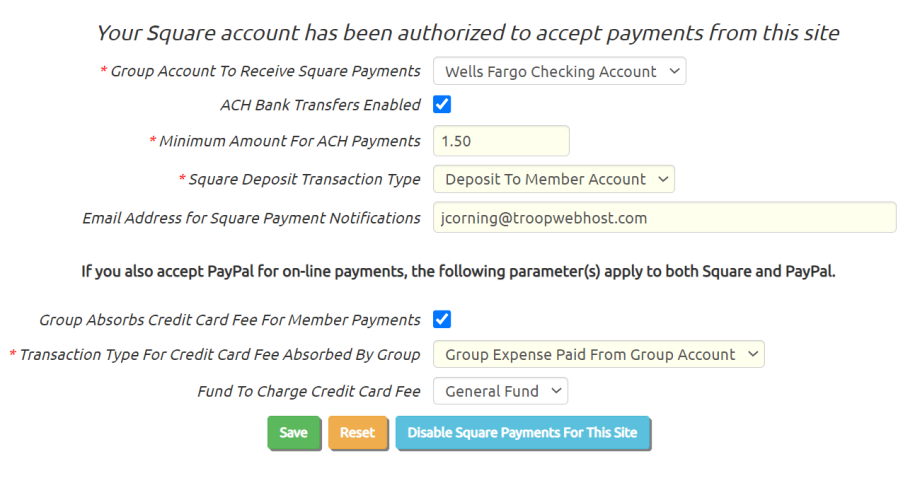

Either way, you will eventually be asked to authorize your OurGroupOnline site to accept payments on your behalf using Square. Once you give your approval, you will return to the Square Configuration page which now looks like this:

You must fill out this form before you can begin to accept Square payments on your site.

The Group Account To Receive Square Payments should be the Group Account that represents the bank account to which you've told Square to deposit your payments. Square will automatically transfer payments to that account on a daily basis.

Enable ACH Bank Transfers will be enabled by default. This will give your members the option of making payments to the group directly from their bank account, which will incur a significantly lower fee than other payment options, especially for large payments. Remove the checkmark from this box if you wish to disable this option.

The Minimum Amount For ACH Payments allows you to prevent your members from making small payments with the ACH option, especially if your group is absorbing the fee. There is a minimum $1 fee for ACH transfers, so for payments under $25 the fee will be higher than if they use a credit card.

The Square Deposit Transaction Type is the transaction type that will be assigned to Square payments to member accounts. Deposit To Member Account is a good choice, unless you want to create a transaction type specifically for Square.

The Fund for Square Deposits must be specified if the Square Deposit Transaction Type requires a fund to credit.

Email Address for Square Notifications should be the treasurer's e-mail address. An e-mail will be sent to this address each time a Square payment is completed.

By default, the transaction fee which is charged by Square will be deducted from the amount deposited to the member's account. So, for example, if a member pays $100 and the PayPal fee is $3.20, only $96.80 will be deposited to the account.

Your group may choose to absorb this fee, which may encourage more members to make on-line payments to the group. If you check the box Group Absorbs Credit Card Fee For Member Payments, a member who pays $100 will see $100 deposited to his account, while the group will incur an expense of $3.20.

If you check the box Group Absorbs Credit Card Fee For Member Payments, you will need to select a Transaction Type For Credit Card Fee Absorbed By Group. This will be the transaction type that will be used to record the expense of the Square transaction fee when the group absorbs the fee.

If the selected transaction type requires a fund to debit, you must select a fund from the drop down list for Fund To Charge Credit Card Fee.

If your group is also set up to use PayPal, then the options you select here for handling the credit card processing fee will also apply to payments made via PayPal.

Click Save to save your work.

Once you've completed this page, you can then authorize your users to access the On-Line Payments function, unless you've already done this for PayPal.

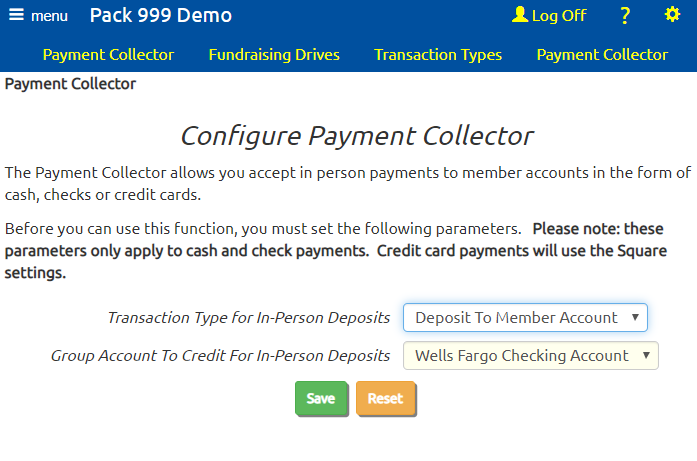

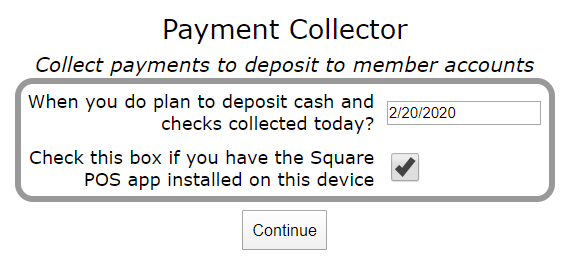

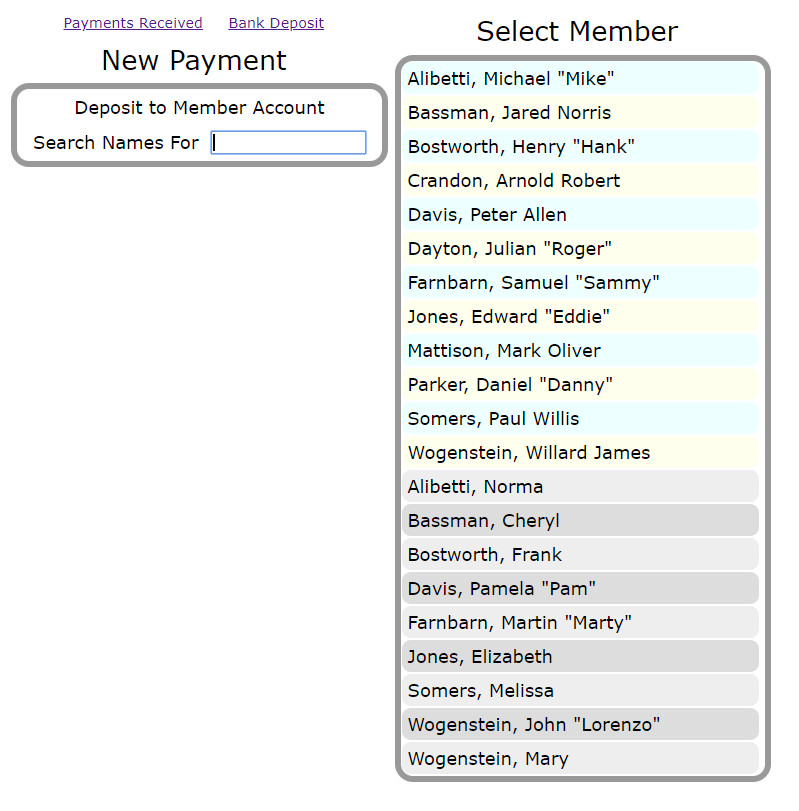

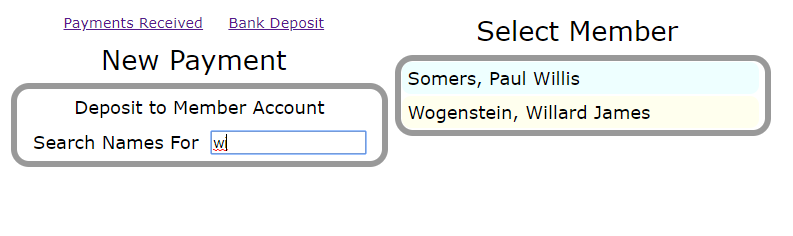

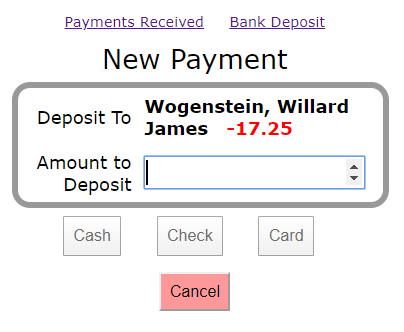

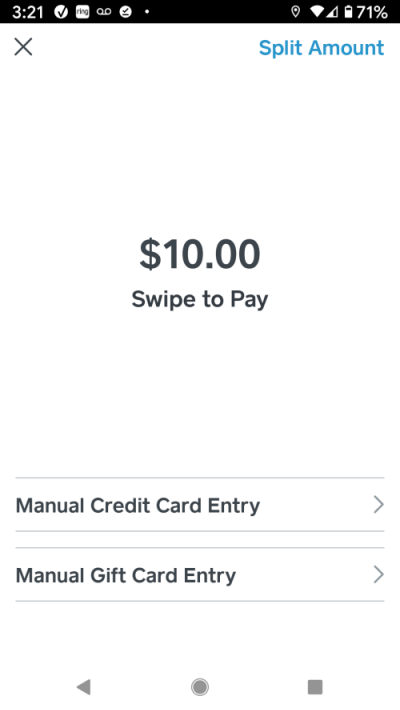

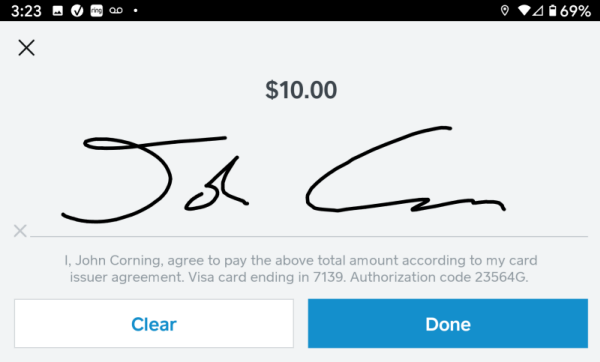

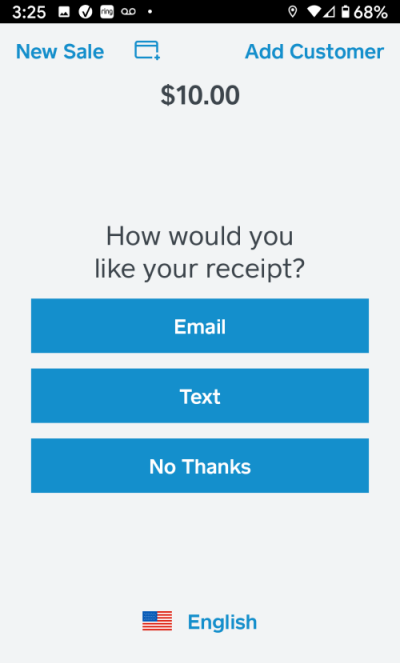

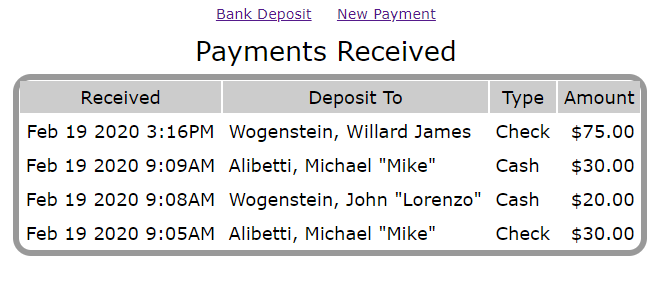

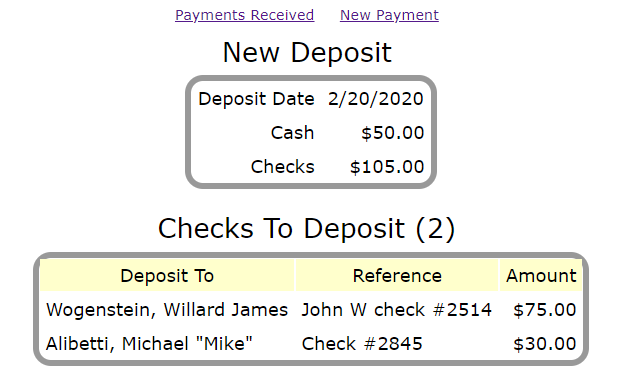

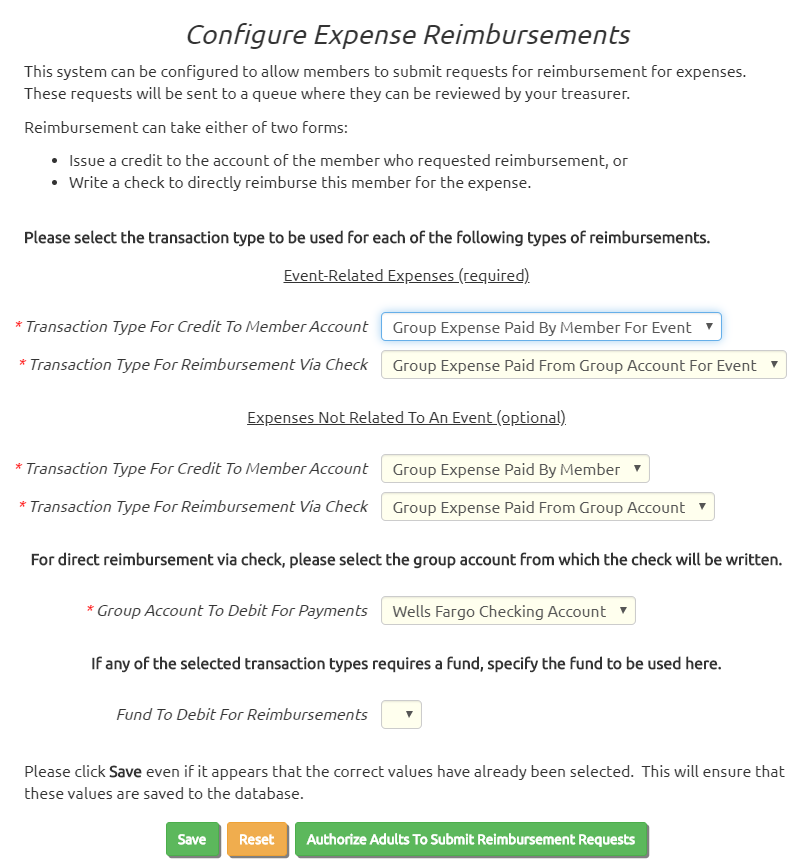

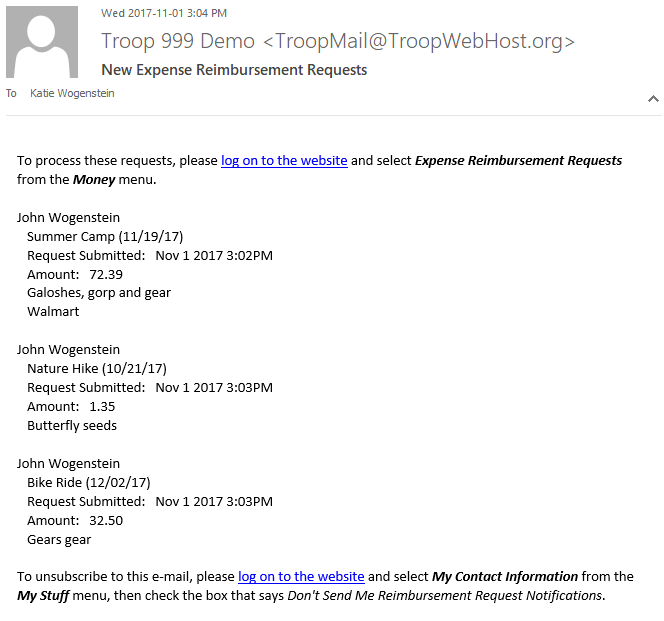

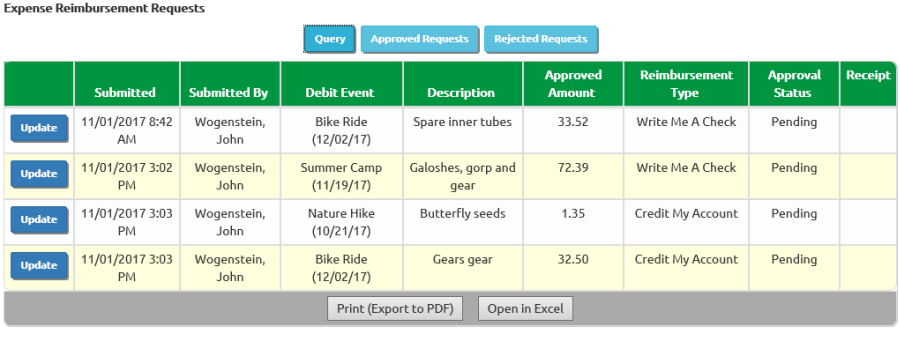

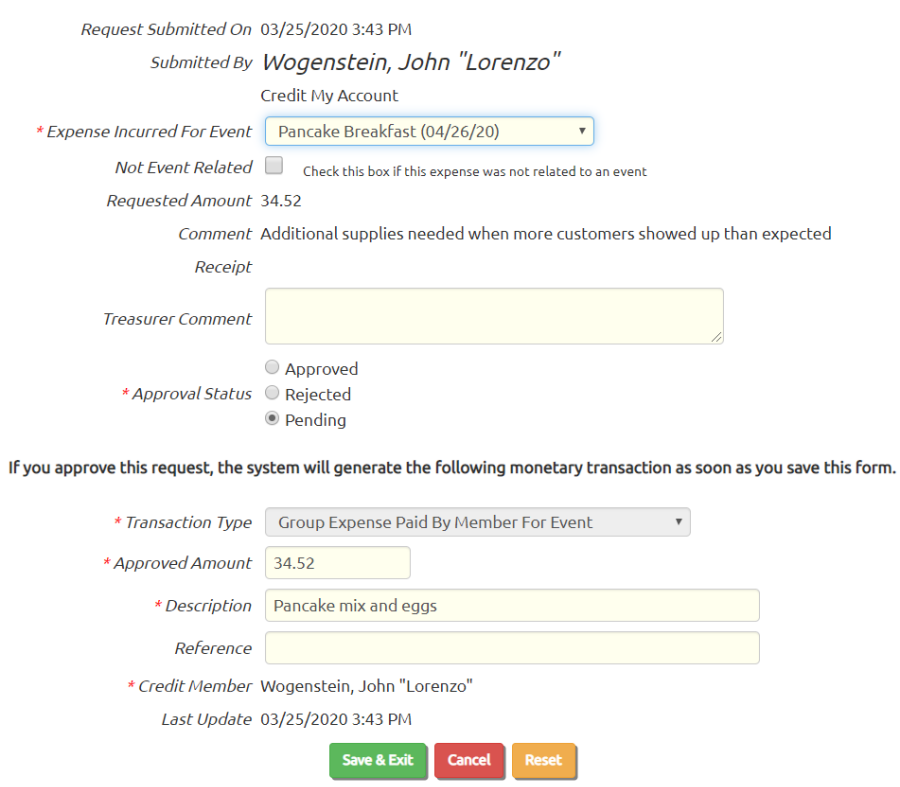

Configure the Payment Collector